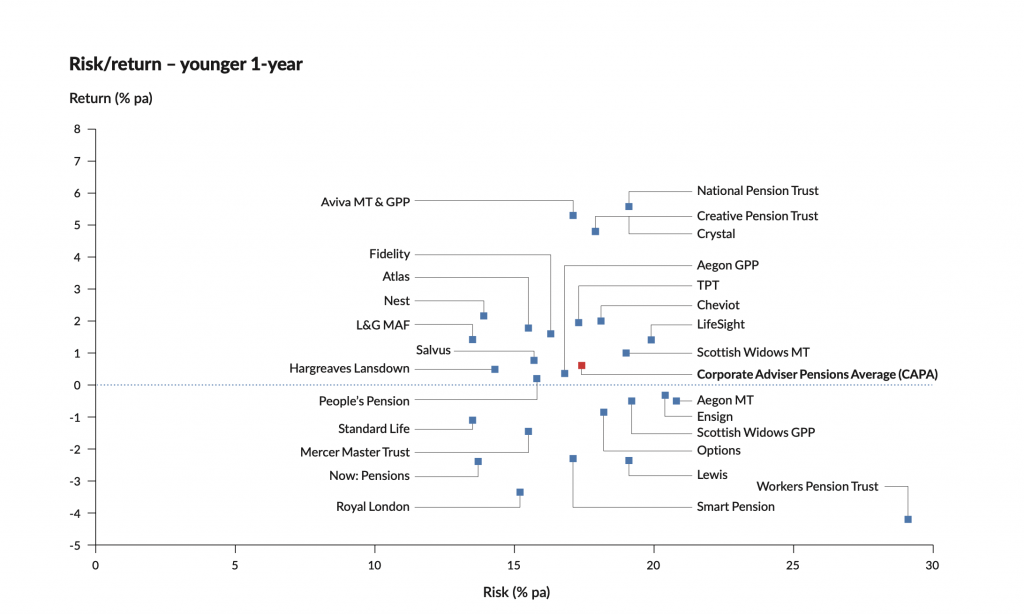

A small majority workplace pension savers have seen their investments completely protected in the year covering the Covid crash, with the Corporate Adviser Pensions Average (CAPA) showing a gross return of 0.61 per cent over the 12 months to June for younger savers.

The CAPA average reflects the returns of 28 master trusts and GPPs covering the vast majority of DC pension savers in the UK. Eleven of the 28 providers featured posted a negative pre-charge return over the 12-month period.

Returns were on average positive for both younger savers – those with 30 years to state pension age – and for the investment strategies used for older savers with five years to SPA. The CAPA average for older savers was 2.19 per cent.

The average risk for younger savers was 17.41 per cent over the period, calculated by volatility measured monthly and then annualised. The best performers over 12 months for younger savers generally took high levels of risk, although the worst performer – Workers Pension Trust – took the highest level of risk by a considerable margin.

National Pension Trust, which follows an aggressive investment strategy for younger savers, saw the highest return over the period, posting an annual return of 5.58 per cent, followed by Aviva on 5.3 per cent, Crystal and Creative on 4.8 per cent and Nest on 2.16 per cent.

National Pension Trust’s risk score was higher than average, at 19.1 per cent, but below that of Workers Pension Trust, which stood out from the pack at 29.1 per cent, and which also experienced the worst performance over the period, down 4.2 per cent gross over the year.

Royal London and Now: Pensions also fell over the period, down 3.35 and 2.39 respectively.

Over five years, Creative led the pack with an annualised return of 11.5 per cent for younger savers. Now: Pensions sits at the bottom of the 5-year table with annualised 5-year returns of 2.8 per cent for younger savers, followed by Standard Life on 3.49 per cent.

National Pension Trust also led the field in the 12-month figures for older savers, delivering a positive pre-charges return of 7.45 per cent, followed by Smart Pension on 5.4 per cent and Aviva on 4.8 per cent. National was also top over five years for the older saver cohort, with an annualised return of 9.94 per cent.

Lewis and Now: Pensions fell most over the year to June 30, down 2.81 and 1.15 per cent respectively, before charges. Now: Pensions was at the bottom of the older saver 5-year table, with an annualised return of 1.75 per cent.

To see performance bar and line charts for master trusts and GPPs, as well as risk/return tables, go to www.capa-data.com.