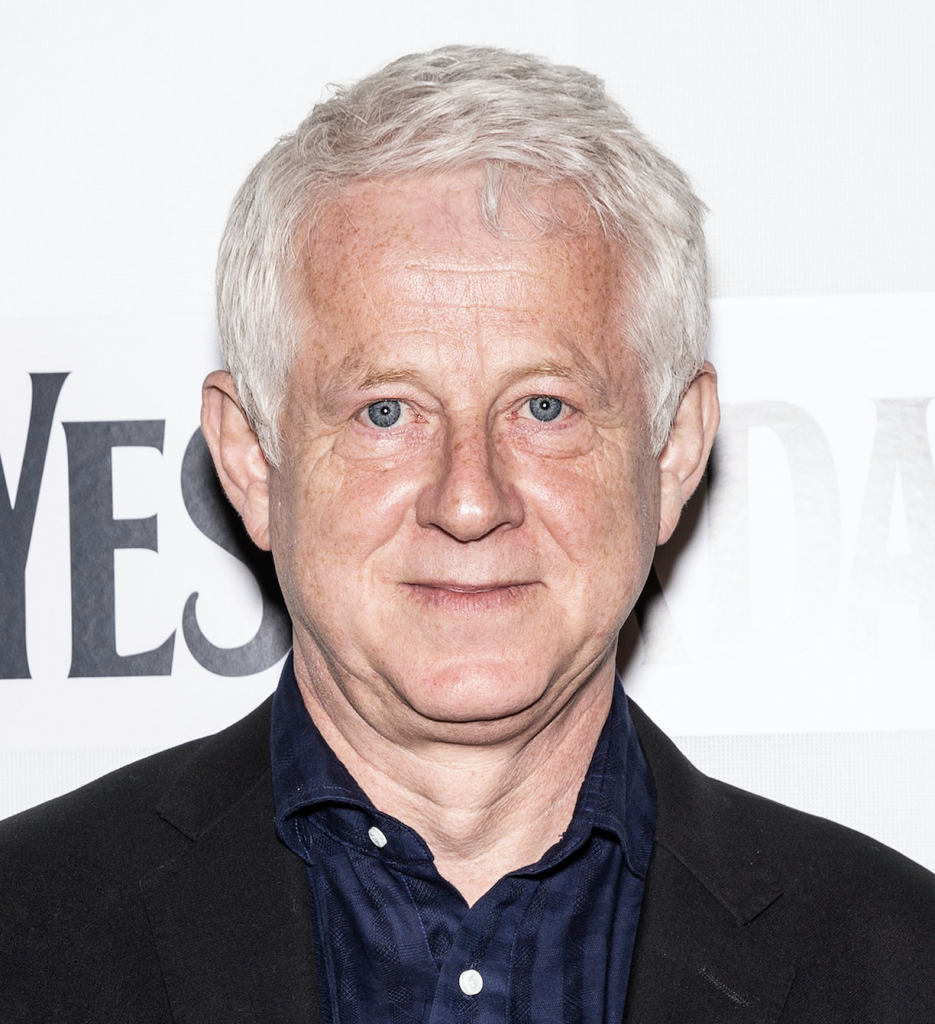

Richard Curtis, co-founder of Comic Relief, screenwriter and film director, has been joined today by Mark Carney and Nest CEO Helen Dean to launch a campaign to get pension investors to commit to net-zero carbon investments.

Curtis, who is known for a series of high profile romantic comedies including Four Weddings and a Funeral, Notting Hill, Bridget Jones’s Diary and Love Actually, launched the campaign, Make My Money Matter, at an event with Mark Carney, former Governor of the Bank of England, and Nest’s Helen Dean.

Its aim is to shift the £3 trillion in UK pensions into sustainable investments.

The initiative is calling on the pensions industry to commit to net-zero carbon emissions by 2050, and for the Government to require, in the forthcoming Pensions Bill, that pension funds report on their emissions projections to 2050 and their alignment to the Paris Climate Agreement

The campaign has published new polling that shows nearly three-quarters of Britons either do not believe or do not know whether their pension is invested in line with their values, with nearly a third saying they care more about the impact of how their pension is invested than they did at the start of the coronavirus pandemic

So far 21 organisations have joined the initiative including Oxfam, WWF, Comic Relief, Triodos Bank, BNP Paribas (UK), Ecotricity, and the Environment Agency Pension Fund, one of the UK’s largest local government pension schemes.

Research conducted for Make My Money Matter has found that 57 per cent of respondents want to see their pensions invested in building a better future for people and the planet post-coronavirus, and 52 per cent want their pensions to be part of the solution in tackling climate change. This demand is contrasted with a lack of knowledge, with the survey revealing that 72 per cent of Brits who have a pension either do not believe or do not know whether their pension is invested in line with their values.

Curtis says: “Our pensions are powerful, and we must use that power to build a better world. The £3 trillion in our UK pension pot is more than enough to take on the climate emergency, bring hundreds of new drugs to market, or help solve the housing crisis. But from tobacco to fossil fuels, gambling to deforestation, pension funds have invested trillions on our behalf without asking us the crucial question – do these investments create a world that we actually want to live in? That is why Make My Money Matter will help people understand their ‘financial footprint’, and empower us all to have pensions we can be proud of.”

Mark Carney, United Nations Special Envoy for Climate Action and Finance, and former Governor of the Bank of England, says: “By helping align finance with society’s values, the Make My Money Matter campaign can support the whole economy transition required to achieve net zero. This could turn the existential risks from climate change into the greatest commercial opportunity of our time. Private finance, including pension funds, will provide the $3.5 trillion needed annually for investments in sustainable infrastructure and fund the innovation and re-engineering of business in every sector of the economy. Make My Money Matter and our work for COP 26 will help investors disclose how their client’s money is supporting these investment needs, so people can decide whether their priorities are being met. This will help deliver the world that our citizens demand and that future generations deserve.”