Workplace wellbeing offers benefits to individuals, employers, the economy and the state, says former cabinet secretary Lord Gus O’Donnell, so the Government would be open to good ideas on how to encourage it

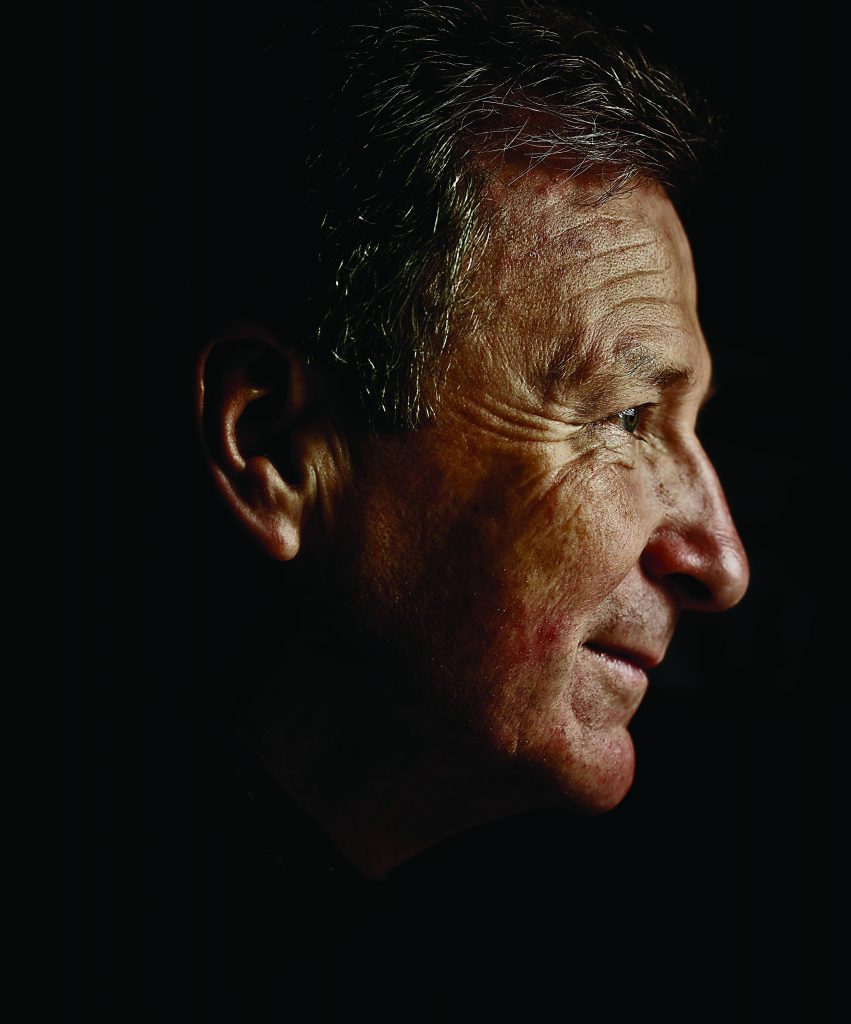

There can be few more convincing advocates of wellbeing and preventative health than Lord Gus O’Donnell. With a CV that includes the role of cabinet secretary to three prime ministers, as well as Treasury secretary and head of the civil service, O’Donnell is well placed to give the healthcare and group risk industry valuable insights into how best to push their case for a greater role for their products and services.

Speaking to Corporate Adviser, the man known in Whitehall simply as ‘GOD’ believes the sector would be pushing against an open door were it to propose an increased role for private-sector interventions – provided, that is, it got its act together.

“Everyone understands we can’t go on like this. The NHS budget is being protected in real terms and is being given more on top, so it is completely dominating overall public spending. And, given our ageing society, that is only going to become more pronounced,” he says.

“So, if the Chancellor is serious about controlling public expenditure, he has got to think about changing public health, in quite radical ways. The kind of things we are talking about must be part of that solution but you have got to make the case.”

O’Donnell has been a vocal supporter of wellbeing as a concept – an idea also backed by prime minister David Cameron since 2010. In October O’Donnell, who is now chairman of Frontier Economics, an economics consulting firm, published a paper with Andrew Oswald of Warwick University arguing that policies that targeted prevention through well-being strategies rather than treatment could help the Government improve public satisfaction levels.

The same logic understood by employers that ‘get’ wellbeing – that healthier workers are more engaged and productive – also applies to the Government, says O’Donnell, who argues that departments can do more with less and will encounter less resistance to change if the people they serve feel generally happier with their lot.

The virtuous circle of wellbeing – healthier people, lower healthcare costs, higher productivity, lower absenteeism and benefits costs, and higher tax receipts – is a message that can play well to the Government, provided it is pitched correctly, says O’Donnell.

“We have had this first step,” he says, “with David Cameron saying early on that he supports wellbeing. Couple that with George Osborne’s number one problem: low productivity. If you put those two together you get a very simple answer, which is that, if you improve people’s wellbeing, you enhance their productivity and reduce sickness absence, and that is a good thing to do in its own right.”

For O’Donnell, an area of wellbeing that needs addressing urgently is the provision of more resources for mental health support.

“You get tragedies in the workplace that highlight mental stress,” he says. “Depression is a huge issue for companies and for society. So tackling that is important, and the scandal of so few people with diagnosable illnesses getting any treatment at all. There were a few hundred million pounds put aside for mental health in the Autumn Statement. It is probably not enough but it is a definite step in the right direction.

“As a chairman of an economics foundation, I’d say it is in businesses’ own interests to get on with this regardless of what the Government does. And we need to be making the case at board level that actually this is an extremely good investment for a firm. Too many firms have thought this was wishy-washy stuff and failed to understand.”

He does see signs of progress, however. “We are starting to see more and more people admitting to the fact they have had time off – including a number of key chief executives (Lloyds’ Antonio Horta-Orsario is a very good example) – and they are fantastic examples because they show not just the extent of the problem but that it is a solvable problem. Antonio is back and is a very successful chief executive in a stressful job, and that shows there are ways of managing these things,” he says.

So does O’Donnell understand the frustration that EAPs and cash plans that can offer preventative services to workers are subject to P11D charges, not to mention healthcare services that get people back to work?

“As a general principle, we will have to move a lot more money into the ‘prevent’ rather than the ‘cure’. This was the theme I had in government – that, as we were trying to reduce the deficit, we were going to have to deliver better for less, and prevent these issues arising in the first place because they were very expensive for the NHS.

“That is the area where government has always found it difficult because it is different budgets for different departments, and different places. In this case, if the corporate sector spends some money the NHS benefits, as would the DWP and Treasury in tax receipts.”

Some figures in the insurance industry believe they can do Return to Work more efficiently than the public sector, but they feel the current system penalises them for doing so. So how should they go about petitioning for change?

“What I would say as a former head of Treasury is that they need to spell that out. They need to get it done in a very objective way; get the evidence out there. The Treasury is interested in productivity in the public finances.

“If they can demonstrate objectively – and not just talking their own book – that this makes sense then that is the kind of thing that will attract more resources. This plays very much with a government that is moving towards a smaller public sector and a larger private sector,” he says.

In O’Donnell’s opinion, the introduction of tax breaks for non-NHS interventions need not be politically sensitive, provided they are targeted at lower earners.

“You could have it that tax breaks were available for people on basic rate only,” he says. But he adds that leaping to tax breaks is not always the best way forward, given that other nudges have proved effective.

He believes the debate around the introduction of a sugar tax is an example of where some pressure groups have made this jump too soon, without fully exploring the alternatives.

“You have to be incredibly careful that you don’t tax one thing so that people move into an area just outside the taxed thing, which is just as harmful. The lesson we should learn from pensions is in trying to encourage people to switch to defaults. So if we can get the default moved towards much lower sugar content, that would be good.

“We just need to do a bit of experimentation. Sometimes tax relief or imposing charges does bring about changes. I am quite taken by the change in behaviour that imposing a mere 5p on a carrier bag has made. It is obviously not the money; it’s woken up people’s mental processes to say ‘Yes, I should bring bags.’

“The problem about people calling for a sugar tax is they are thinking about only one thing, which is ‘We should tax this.’ And the reason you have not got economists right behind this is because they are more behaviourally smart and want to see what really works. So if a tax works, fine, but what else could work? But if it turns out that a tax means sugar substitutes come in that are just as bad or possibly worse, and which you have left outside the tax, then what have you achieved?” he says.

O’Donnell believes there is also mileage in pushing the wellness agenda through benchmarking. Although the BITC Workwell initiative faltered last year when only nine FTSE 100 companies self-completed its survey, O’Donnell argues that getting wellbeing measures into corporate accounts has mileage, provided it is seen as coming from business. “It is a hard message if it is comes from government as it will be seen as piling more red tape on industry. You will find that the people who believe it makes a difference will want to do it and get behind it.” he says.

O’Donnell believes the idea has genuine mileage because it ticks that crucial box of playing to agendas within both the Cabinet Office and Treasury.

“We have the happy situation at present where the Cabinet Office and Treasury are working in relative harmony. This fits with David Cameron’s position on backing a wellbeing agenda and George Osborne’s drive to increase productivity – albeit Business, Innovation and Skills may see it as more red tape for industry.”

As nudges go, the billions spent on pension tax relief are among the least efficient to date, suggests O’Donnell.

“The key thing that has made people save is nothing to do with tax reliefs – it is the change through auto-enrolment. It has been massively more effective,” he says.

He points to the evidence of Raj Chetty of the American Economic Association, whose examination of tax records in Denmark concluded that every £1 spent on tax relief on pensions had led to just 1p in extra saving.

O’Donnell agrees that Osborne faces a huge decision regarding the potential switch from pensions tax relief to a so-called pension Isa model – the ‘EET to TEE’ switch – which could net him more than £300bn if the entire £1.6tn in funded pensions were switched over night.

“It is a very big decision to have to make. Part of what he is saying is ‘Let’s tax pensions up front and make them tax-free at the end.’ So you get your £300bn or whatever up front, but does the Government end up spending that and then taxing the income in retirement after all?”

Unsurprisingly, this would be very complex and risky to implement, he says. “There are issues around Solvency II and, if you were suddenly to redeem £300bn of gilts, there would certainly be a significant market impact.”

But despite the questionable nature of the incentive being offered through upfront tax relief, O’Donnell does not think the Chancellor will press the nuclear button and opt for full-fat TEE.

“He needs to be wary of the knock-on effects that such a big change could lead to. I don’t think he will do that, but that is just my reading of the situation,” he says.

Gus O’Donnell, Baron O’Donnell of Clapham

BORN: 1952

Education: Salesian College, Battersea; read economics at Warwick University; MPhil, Nuffield College, Oxford; PhD, University of Glasgow

Career highlights:

2002-05: Permanent secretary to Treasury

2005-11: Cabinet secretary

2005-11: Head of civil service