Legal & General is moving around 2 million contract-based DC pension savers into its Lifetime Advantage Fund which has a 15 per cent exposure to private markets at an increased fund management charge.

Contract-based savers in the huge Multi Asset Fund will be moved across to the Lifetime Advantage Fund without direct member consent under the terms of L&G’s contracts, although employers will have the option to switch back to a lower cost default should they wish.

L&G modelling suggests the new Lifetime Advantage Funds, launched in July, have the potential to deliver a 40 per cent better outcome in retirement for a 20-year-old member, when compared with the Multi-Asset Fund default.

Charges are tiered based on the age of the member, with the investment management charge standing at 15bps for 2035 target dates, rising to 19 bps for 2035-2040, and 23bps for 2040 target dates and beyond – a significant step up from the low cost MAF, but the provider says the switch is justified by the potential extra performance the new option could deliver. A further 5bps ‘expected additional expenses’ reflected performance fees is also predicted. That compares to 13bps for the MAF.

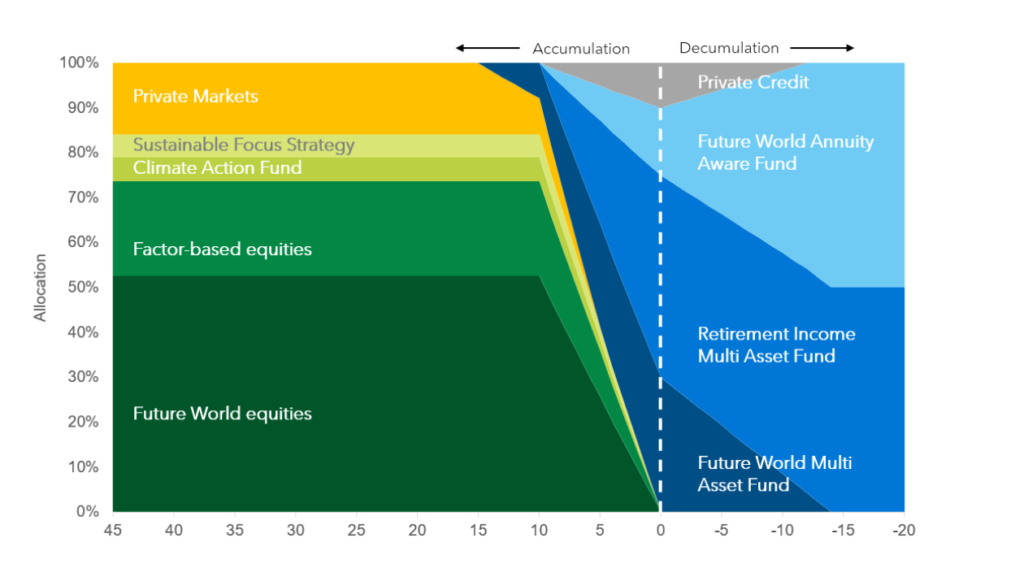

The 15 per cent private markets exposure is delivered through the L&G Private Markets Access Fund, which has direct exposure to assets such as affordable housing, university spinouts and renewable infrastructure. The other 85 per cent of the fund is invested in ESG and factor-based equity strategies, including Sustainable Focus Equity Strategy, delivering thematic exposure to a number of the UN’s Sustainable Development Goals (SDGs), including clean water, clean energy, and healthcare; the Climate Action Global Equity Fund an actively managed, high conviction strategy which focuses on actively engaging with climate laggards to accelerate progress and unlock improvements; and a Technology Sleeve, which is a focused 100 stock portfolio with an ESG overlay, providing access to companies that are leading the technological revolution.

As the member approaches retirement the Lifetime Advantage Funds transition gradually into a more income-focused portfolio, with the aim of protecting growth and delivering flexibility.

Rita Butler-Jones, head of defined contribution at Legal & General, said: “We’re really excited to be introducing the Lifetime Advantage Funds as the new core default for our contract-based DC scheme clients. In our view, the funds offer members access to an innovative, growth-oriented portfolio of investments with the potential to deliver excellent performance and value over the long term.”