Taking on more risk, embracing ESG and illiquids and achieving lower charges through scale could increase retirement pots by 16 per cent over a saver’s lifetime, according to a new report by the Pensions Policy Institute.

The fifth edition of the PPI’s DC Future Book argues that combining these changes with an increase in contributions of 1 per cent of earnings, from 8 to 9 per cent of total pay, could boost pots by up to 29 per cent.

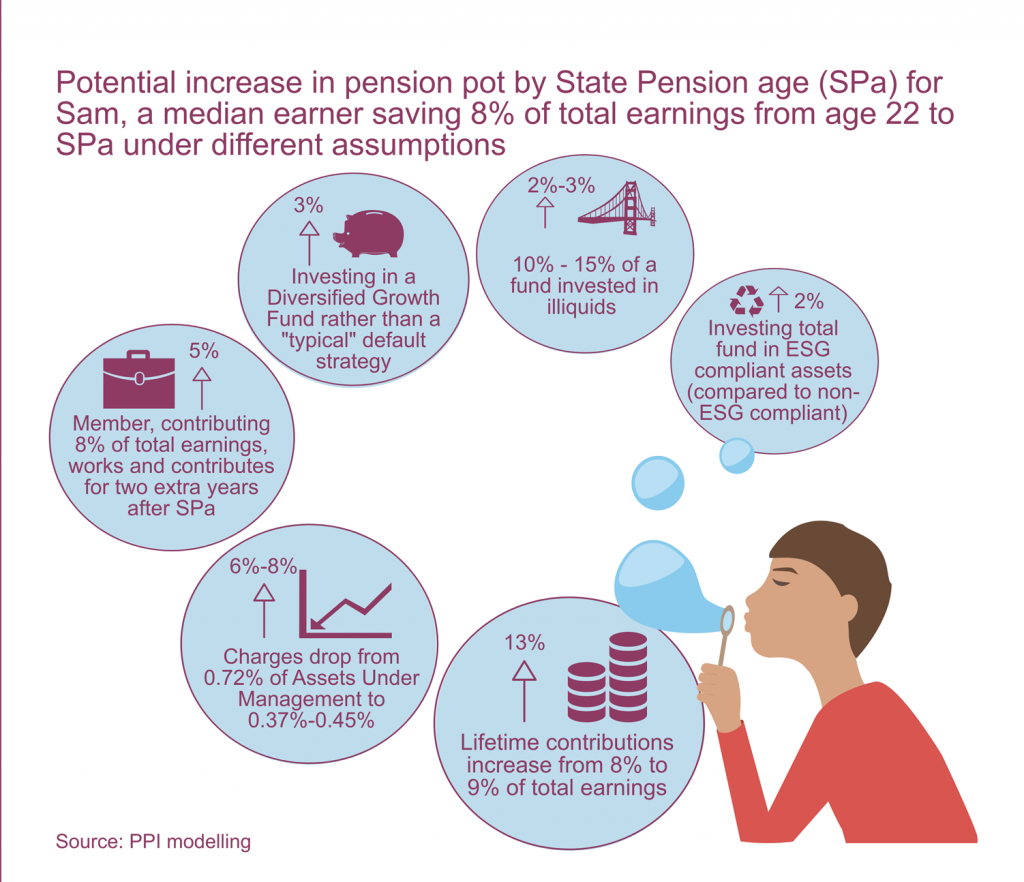

The report, saysmoves away from significant de-risking in the approach to retirement can increase pot sizes at State Pension Age (SPA) by around 3 per cent, though significant de- risking will still be appropriate for savers who wish to purchase an annuity.

It argues the use of illiquid funds and investment in funds that take account of the financial implications of ESG could both have the potential to boost pot sizes over the long-term by 2 to 3 per cent, though can be more resource-heavy to manage.

A drop in charges, arising from scheme growth or consolidation could see individuals achieving pots between 6 and 8 per cent higher in retirement, based on AMCs falling from 0.72 per cent to between 0.37 and 0.45 per cent.

But the report argues that increased contribution levels and/or longer working are still likely to have the most significant impact on member pension pot sizes, increasing pots at SPA by 13 and 5 per cent respectively.

PPI head of policy research Daniela Silcock says: “This report is being published during a period of great change as government and industry adapt to the increase in DC savers arising from auto enrolment, from 5.5 million DC members in 2012 to 13 million today, and the pension flexibilities, which have significantly altered the opportunities and risks faced by DC scheme members. In the background, economic changes and changes in investment trends are influencing the way scheme managers approach the investment of member contributions.

“It’s important to recognise the good work that government and industry have already done to ensure that the DC pensions market meets the needs of those saving for retirement, over a relatively short period. We are still going through the process of adaptation and the Future Book 2019 identifies the way that policy and debate about governance and investment is currently evolving and estimates how improvements could affect individual DC pot sizes.”