The UK is on course for an all-industry pile-up that could make the crash of 2008 look like a mere prang. And the really worrying aspect is that the vast majority of CEOs and company boards are turning a blind eye to the looming danger.

Why? Because it involves their people. And whilst they might value their people, the risk associated is this seemingly unfathomable thing that sits with HR, right? Wrong. Unless C-Suite executives are helped to understand the risks ahead and strengthen their people strategy – by advisers who in many cases also need to get to grips with these issues and take more of a consultancy-led approach – they will simply lose their competitive edge.

HR and adviser trade media make regular mention these days of somewhat confusing terms such as ‘employer value proposition’ and ‘employee experience’. Although seemingly different, they are all driven by one overriding goal: namely, encouraging companies to understand and mitigate their people risk.

This requires HR to try to make it clear to the board – because in many organisations the top-down approach doesn’t seem to be materialising – via robust facts and figures that people risk is more than just an HR issue. This, in turn, requires strong consultancy support.

As Mark Ramsook, head of sales & marketing for the health & benefits division of Willis Towers Watson points out, when it comes to implementing changes in people strategy: “If there’s no sincerity from board level down, it’s whimsical at best.”

“If clients don’t understand the value of the different types of insurance and how they help people it’s never going to happen. But if there is management buy-in it suddenly moves from a corporate / broking discussion to a very emotive one, which requires experience and the use of anecdotes and case studies to help get the message across.”

Driving forces of change

According to Mercer’s latest Workforce Monitor report, the UK “is sailing into an unprecedented labour shortage” thanks to an ageing population and an expected fall in immigration from the EU in coming years. This comes at a time when dependency ratios are increasing, with fewer people working and more retirees to pay for.

Against this backdrop, Mercer’s analysis finds that companies will be forced to change their people strategy and find new ways to do more with less. This might include retraining older workers, attracting workers of all ages through apprenticeships, helping more women return to the workforce and automation of jobs.

Central to all of this is managing the health and wellbeing of the workforce they already have – one that is getting older and with more caring responsibilities at the one end and, at the other, struggling with inflexible workplaces, job uncertainties and financial insecurity.

Overcoming barriers

This represents somewhat of a dilemma for HR and consultants alike. The simple answer to managing the health and wellbeing of employees would be to extend benefits to all. But that comes at too high a cost for most.

Consequently, the vast majority of companies in the small to mid-sized space barely have any benefits in place. And those at the larger end that do, are looking to reduce their benefit spend.

Willis Towers Watson’s latest Benefits Trends Survey found that 50 per cent of HR decision makers see rising benefit costs as a key challenge over the next three years, while 35 per cent are concerned they’d have insufficient budget to make benefits changes.

The PMI paradox

Currently the provision of traditional health and protection insurance products is low and, in the case of private medical insurance (PMI) at least, still sometimes seen as a perk for senior executives.

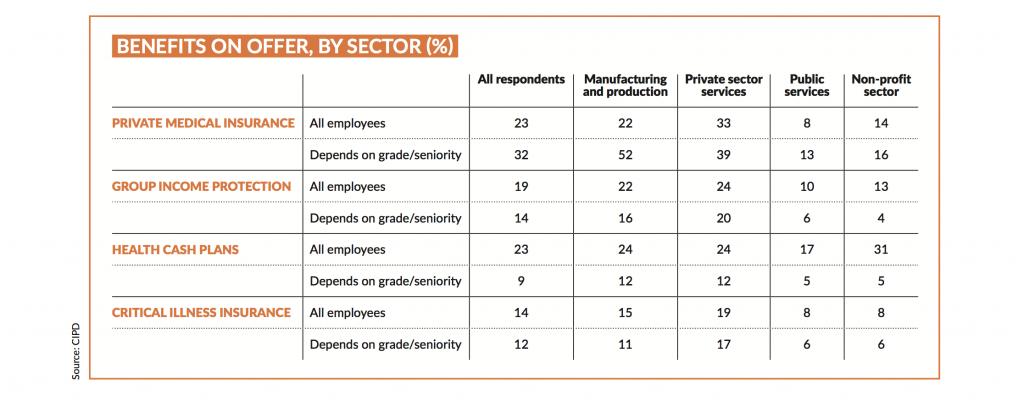

The CIPD’s Health and Well- Being at Work3 report found that across all company sectors surveyed, a higher percentage of HR respondents said its availability in their workplace was dependent on grade / seniority as opposed to being offered to all employees. The disparity was greatest in the Manufacturing and Production sector at a ratio of 52 per cent seniors only/22 per cent all employees. Across all sectors, just 23 per cent provide PMI to all employees.

The reason that PMI is often still seen as a management benefit is that employers don’t view themselves as being exposed to the cost of employee ill-health thanks to the perception that the NHS will pick up the tab comments VitalityHealth director of corporate wellness strategy Shaun Subel.

“However, we feel that this is changing,” he adds. “As employers increasingly recognise the advantages of providing their employees with quick healthcare access, as well as encouraging them to lead healthier lives – which can have important business outcomes in terms of employee engagement and productivity – we are seeing more employers seeking to explore products which broaden the availability of PMI and of wellness within their organisation.”

Vitality’s Britain’s Healthiest Workplace Survey helps evidence positive correlations between health, wellbeing and productivity, demonstrating a return on investment for those employers providing wellness linked PMI products or general workplace wellness solutions.

Added value vs standalone

The CIPD also found that 19 per cent of companies extend group income protection (GIP) to all with 14 per cent saying it depends on job level. While 23 per cent provide health cash plans (HCPs) to all, just 9 per cent do to senior execs only.

In contrast, the provision of wellbeing services is high. Over three fifths of respondents said free eye tests, access to counselling services and employee assistance programmes (EAPs) were available to all employees. The next most popular benefits for all employees were advice on healthy eating and lifestyle, in-house gym or subsidised gym membership, free flu vaccinations, and programmes to encourage physical fitness, pedometer initiatives or other fitness trackers.

All of these benefits and services – to varying degrees – are provided as part and parcel of certain group IP, HCP and PMI products. So cost / benefit analyses of standalone wellbeing services in comparison to insurance packaged solutions are essential.

In the case of HCPs, for example, this kind of route could end up being cost neutral and bring even more services to companies and employees, says Health Shield head of business development David Willetts. He adds that the business case for a cash plan can be made by simply educating companies on what they are, how much they cost and how they can help. “A simple approach is often all that is needed,” he comments.

“When companies realise what a cash plan can provide and the cost, they are much more receptive and willing to introduce it.”

The ability to tailor schemes to need and budget is also useful. “We can design a product with various company paid levels,” adds Willetts. “This allows companies to put staff on different levels and this may be based on seniority, length of service, contractual obligations or locations.”

Stop broking, start consulting

Meanwhile, Canada Life Group Insurance group income protection proposition manager Scott Rayner says that help is needed from the adviser community to change the perception of group IP from being salary insurance only to something that employees can use every day.

“When an adviser gives us access to the decision makers of clients – to their absence data and sick pay policy – we can build a cost / benefit analysis and evidence how group IP adds value.”

A case study by Canada Life shows that for one financial services client last year, 97 per cent of referrals to early intervention services were resolved before claim payment and 76 per cent resulted in a return to work in an average of four weeks. This resulted in over £250,000 of value – estimated using the client’s average salary of £63,751 and 65 days of full occupational sick pay, followed by 65 days at 75 per cent. When the associated value achieved via the use of the built-in EAP and second medical opinion service were incorporated, this increased to a total estimated wellbeing value of £285,000. Against an annual premium of £736,000, this resulted in a net salary insurance spend of £451,000. “If advisers continue broking and don’t start consulting, group IP will die,” adds Rayner.

Future view

With the nature of employment in the UK shifting more towards flexible working, self-employment and contracting, Ramsook expects to see a shift towards companies taking benefits off payroll and instead leveraging their buying power to offer corporate rates on self-pay products and services.

He explains that the advantages of this are three-fold. “It limits volatility for the employer. It provides cover that people need. And it allows for portability of benefits, something that better meets the needs of a more agile workforce.”