The Oliver Wyman report says that despite the steady consolidation in the corporate pensions market and increased contributions under auto-enrolment, profitability will remain a challenge for the handful of life insurers still active in the sector, unless they create propositions for the more profitable retirement income stage, making themselves the ‘Financial Home’ of the customer. As well as drawdown and annuities, this will involve an increased focus on equity release, a sector which has seen a significant increase in recent years, as well as non-financial products.

Even if the industry was to consolidate to one or two players, it would still be unprofitable at current margins, says the report, which estimates that insurers will have around £1.5tr on investment platforms by 2026, of which £1tr will be in corporate DC.

UK life insurers have the potential to add £7.5bn of annual cash generation to their industry and £100bn of shareholder value by 2021 if they move beyond pensions to provide a range of financial and older age services, the The Retirement Franchise Opportunity report argues.

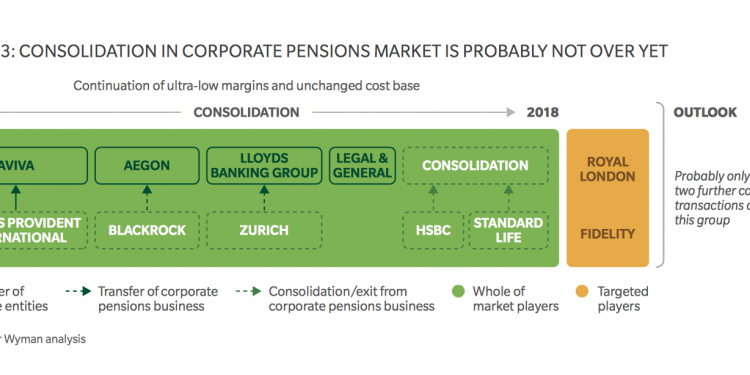

The report singles out Royal London and Fidelity as potential consolidation targets, following the transfers of the corporate pensions books of BlackRock, Standard Life and Zurich to new parents.

The report argues that life insurers would be more attractive if they could provide a long term reliable flow of satisfied customers into the more profitable retirement income stage, choosing to stay rather than doing so out of inertia. It says insurers are investing heavily in the analytics and processes that will support future new retention strategies but need to completely reinvent the way that they interact with clients and have a strong ambition of becoming the clients’ ‘Financial Home’.

The report argues that over the longer term, insurers will derive revenues from multiple sources, including general insurance, banking services, and increased involvement in non-financial expenditure such as recreation, energy, long term care residence, power of attorney and funeral planning. They will also increase the revenue they earn from existing business lines, such as equity release. The client’s lifestyle and financial profile provides a strong base for continuously developing and enhancing products and services.

Oliver Wyman partner and lead author John Whitworth says: “Life insurers must shift from their current narrow product focus to a client relationship-based proposition. In doing so, they have the potential to build client relationships that are stronger than those with retail banks, becoming the ‘Financial Home’ for the over 50s.”