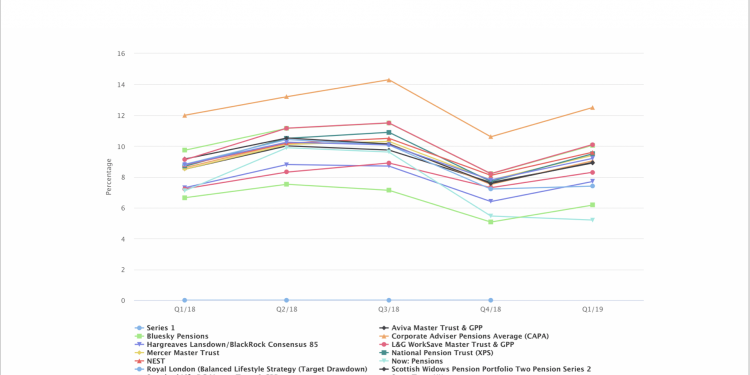

Research by Corporate Adviser Intelligence has revealed massive differences in returns, meaning some unlucky savers could end up significantly worse off in retirement due to their employer’s choice of pension scheme. View performance tables here.

To receive a PDF copy of the Corporate Adviser Master Trust Defaults Report, click here.

Bottom of the table for growth phase savers is Now: Pensions, which has returned 5.2 per cent a year over five years – less than half the rate of annual return achieved by the best-performing trust.

Top performer, Supertrust UK, achieved annual returns of 12.5 per cent over the same period beating 9.04 per cent average across the 22 trusts with a five-year record covered by the analysis.

All comparisons are based on a saver who is 30 years away from retirement and cover the five years up to the end of March 2019, excluding management fees.

Huge differences in returns uncovered by the research mean that a saver who invested £1,000 in Now: Pensions five years ago would have just £1,296 whereas if their money was in a trust with average performance it would be worth£1,569 today – before charges are deducted.

However, a saver who invested the same amount in Supertrust would be close to doubling their money as it has turned £1,000 into £1,862 over the same timeframe – before charges.

Now: Pensions’ cumulative returns over five years were 30 per cent compared to the 86 per cent delivered by Supertrust.

The best-performing trusts have been those with the highest allocation towards equities, while those with a greater weighting in bonds have not enjoyed the same returns.

Now: Pensions’ performance has in part, been held back by a decision to hedge against currency fluctuations. While this is arguably the right approach for a default to adopt, it means Now: Pensions missed out on the performance boost that followed the EU referendum, when the fall in the value of the pound boosted the sterling valuations of defaults, all of which have predominantly overseas earnings in the growth phase.

Other funds showing below-par performance over the period were the Standard Life DC Master Trust which delivered annualised returns of 6.17 per cent and Hargreaves Lansdown at 7.7 per cent.

Strong performers included Crystal Trust at 11.67 per cent, TPT at 10.1 per cent and Bluesky Pension Scheme at 10.05 per cent.

Comparing default funds is complex. Different charging structures, contribution rates, target customer audience, benchmarks and derisking strategies mean like-for-like comparisons are difficult to achieve.

Performance is shown gross – ie before charges have been deducted, as this enables a focus on the investment skill of the default strategy. It also avoids the complexity of reflecting deductions for charges when many providers offer different charging structures to different employers.

Performance figures are only part of the picture of whether a scheme is good or not, and reflect a snapshot in time that presents data from a particular set of market circumstances. If markets had performed badly rather than well, many of those defaults towards the bottom of the tables would be at or near the top, having fallen less than riskier, more aggressive funds.