Personal pension saving has almost regained the peak seen before the financial crisis, with £20.3bn contributed to personal pensions in 2014-15, just short of the £20.9bn contributed in 2007-08.

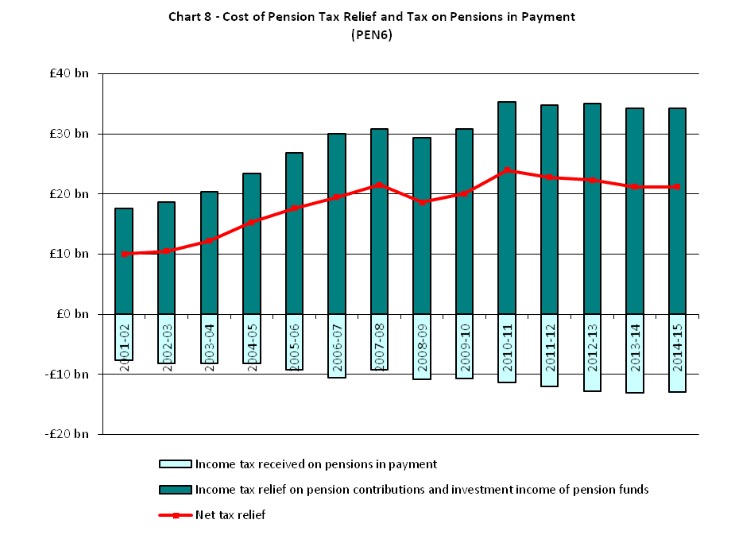

The 2014-15 figures are considerably higher than the £18.4bn in 2013-14. But the amount of tax relief has remained flat over the last four years, standing at £34.2bn in 2014-15, slightly down on the £34.3bn the previous year, suggesting the reduced annual and lifetime allowances are so far more than offsetting the increased tax relief costs of auto-enrolment. Tax revenue from pensions in payment stood at £13bn in 2014-15.

The HMRC data shows around 63 per cent of men are paying into personal pensions, compared to 37 per cent of women.

Old Mutual Wealth pensions technical expert Jon Greer says: “As we approach what looks like being a critical Budget for pensions, the HMRC data offers a number of compelling insights into the current state of personal pension saving in the UK, and one or two useful indicators for the future.

“Those under the age of 35 now make up a larger percentage of those contributing to personal pensions than before which is encouraging to see. The danger here is that any radical change announced at the budget puts the brakes on this newfound enthusiasm for saving into a pension.

“The data also shows that tax relief given on contributions to registered pension schemes is maybe not the unstoppable juggernaut some think it is. Annual allowance reductions appear to have helped maintain the cost of relief at a relatively flat level for the past four years, and the introduction of the tapered annual allowance for those earning over £150k in April could assist in maintaining that level further. Should a flat rate be announced in March, our suggestion that the annual allowance be used as a lever to maintain the affordability of tax relief at that level, appears to be a concept that has already had some effect.

“On the other side of the coin, the income tax received on pensions in payment is likely to show an increase for this tax year, as pension freedoms introduced last April have seen in excess of £3.5bn withdrawn from pots. This data could be a crucial tool for treasury modelling ahead of making a decision on the direction of travel for pensions tax relief on March 16.

“While it is encouraging that more young people are saving into a pension and overall contributions are on the rise, there are a couple of areas of concern. The decline in pension savings among the self-employed is a worry. Entrepreneurs and wealth-creators are crucial to the future prosperity of the UK, but it is important they find a way to build a nest-egg to go alongside the investment they make in their own business. We’d like to see some more in-depth data on the decline in pension contributions from the self-employed, to better understand whether they are under-saving in comparison to the rest of the workforce.

“Similarly, it is concern that men still account for around two-thirds of pension savings. While this is a natural consequence of the earnings gap, it is important that families build a financial plan that ensures those saving less themselves are provided for should anything happen to the primary earner or saver.”

Prudential pensions expert Vince Smith-Hughes says: “Closing the pension provision gap remains a huge challenge but these stats show that UK savers are slowly but not so surely getting there. While the total number of people contributing to a pension scheme is up, the nominal average contribution per person has continued to fall. As more employees are auto enrolled and the contributions increase, we would hope to see both the number of pension savers and the total amount of pension savings increase.”