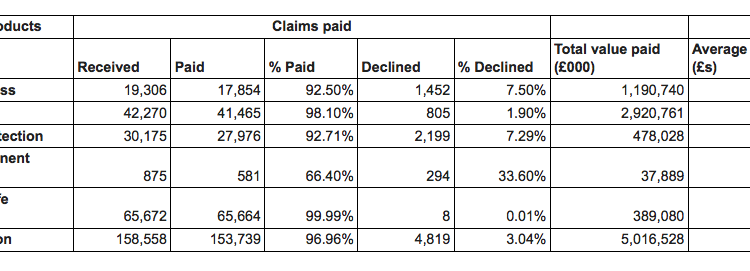

A total of 97 per cent of protection claims were paid by the industry in 2015, although 7.5 per cent of critical illness and 7.3 per cent of income protection claims were declined.

Figures from across the whole protection industry collated by the Association of British Insurers (ABI) and Group Risk Development (Grid) show that 1.9 per cent of life claims were declined, while 33.6 per cent of total permanent disability claims were rejected. The industry paid out over £5bn in claims, with the average payout £69,098 for life insurance, £61,677 for critical illness,£65,213 for total permanent disability, £17,087 for income protection and £5,925 per cent for whole of life assurance.

ABI assistant director, protection and health Raluca Boroianu-Omura says: “Insurance provides vital support to families by relieving the financial strain following a death, serious illness or injury. Products such as income protection, life insurance and critical illness can improve people’s financial resilience.

“It’s important that we encourage people to consider the financial risks if they need to leave work because of illness or injury. As well as financial support, protection insurance can help prevent people needing to leave work, and if they do need to leave due to illness or injury, rehabilitation services can help them return to work sooner. As a result, protection insurance benefits individuals and employers, and relieves the burden on the State, helping the economy to grow.”

Grid chairman Lee Lovett says: “These consolidated claims statistics show the hugely significant support that protection insurance provides for individuals and their families, whether via individual policies or cover provided by employers.

“Despite this, the major challenge for our industry is that a material proportion of the working population have no or insufficient cover and Grid’s focus is on improving awareness and ultimately increasing the number of lives that have access to cover via their employer.”