The Lifetime Isa nudges savers towards giving up pension contributions, risking cutting their retirement fund by a third, the Pensions Policy Institute has warned.

A PPI analysis of other countries that combine pension saving with early access has concluded that the Lifetime Isa has less inherent protection than other options.

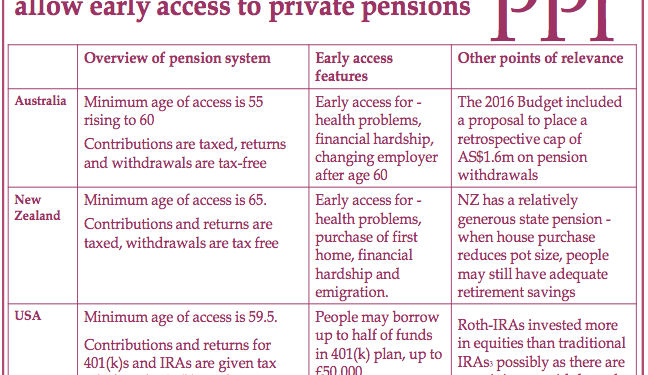

The analysis, which looked at Canada, the US, Singapore, Australia and New Zealand, says products available in countries that allow early access to retirement savings typically have mitigating features that are lacking in the Lifetime Isa.

- Lifetime Isa savers risk missing out on employer contributions. In the UK, people are required to set up a new savings vehicle alongside or instead of their pension if they wish to use the Lifetime Isa to save for a home, rather than make withdrawals from their pensions, as is permitted in other countries. This means that people wishing to combine pension saving and saving for a home might forgo employer contributions, which can reduce the funds available at retirement by up to a third, says the PPI. Take up of the ability to borrow or make early withdrawals directly from their pension pots for a house purchase is low at around 2 per cent in Canada and New Zealand.

- No ability to repay, depleting pots. The Lifetime Isa system lacks a repayment facility, resulting in a greater reduction in pot size for Lifetime Isa savers than for those in countries required to repay. In Canada and the US people must repay early withdrawals in order to avoid tax penalties. In the US about 40 per cent of people take loans from their 401(k) plan, with about 10 per cent of these defaulting on at least some payments, incurring tax and other penalties totalling $6bn (£4.2bn) a year.

- Early access schemes tend to have more conservative investment approaches than those that do not. KiwiSavers (NZ) also seem to favour relatively conservative investment approaches. The PPI says that if this association also translates into more conservative investment behaviour for Lifetime Isa savers in the UK, then they may accrue smaller pots than people making the same contributions would do in a private UK pension scheme. The report says 14 per cent of KiwiSaver members are in the conservative default funds, while 43 per cent of the remainder have selected conservative, cash or fixed interest funds, even though two-thirds of members are aged under 45. New Zealand’s early access system may have led to more conservative investment approaches in order to limit volatility and maintain funding levels for early withdrawals. The report finds some indication that early access schemes are linked to more conservative investment strategies, with US pension schemes that allow borrowing tending to be more conservatively invested than the schemes which do not allow borrowing.

- No break on withdrawals in retirement. The Lifetime Isa’s taxed, exempt, exempt (TEE) structure means there is no break on withdrawal, meaning retirees may run down their pots more quickly. The analysis notes that some pension schemes in other countries that allow early access also use tax to incentivise phased withdrawals in retirement. While UK private pension schemes also have these incentives, Lifetime Isas will not. As a result, those saving for retirement in a Lifetime Isa may withdraw larger lump sums during retirement and run out of funds earlier than they would have if they had saved in a private pension.

- Extra admin charges for monitoring withdrawals. The PPI says providers might need to monitor eligibility and compliance with early withdrawal regulations. The added administrative burden could result in extra charges for Lifetime Isa savers.

- Less regulatory protection. The PPI also points out that other countries combine early access with private pension schemes, meaning savers are protected by pension regulation. Lifetime Isa savers will not be protected by pension specific legislation in the UK and may not benefit from protections such as the charge cap.

- No easy access to income withdrawal options. The PPI also points out that unlike in other countries, Lifetime Isa savers won’t have easy access to the same income conversion options as people saving in private workplace pensions. Lifetime Isa savers are unlikely to use traditional drawdown or annuity products, which are designed to help people manage funds in retirement and make withdrawals in a phased way.

- The risk that tax will be levied by future governments. The analysis also argues that tax exemptions in a TEE system are not guaranteed. It says in systems where the Government feels people are taking too much tax-free income in retirement they may apply retrospective taxes or caps on the amount of income which can be withdrawn tax- free; as seen in the Australian experience, where the 2016 Budget placed a retrospective AUS$1.6m cap on pension withdrawals.