Sir Philip Green is the one person ultimately responsible for the BHS collapse that has left 11,000 people’s jobs and 20,000 pensioners’ benefits at threat, the Work and Pensions Committee of MPs has concluded.

In a scathing report published today, Green was described as ‘adopting a scattergun approach’ to firing blame at everyone except himself.

Describing the BHS debacle as ‘the unacceptable face of capitalism’, the report, by a cross-party committee of MPs, put the blame at the door of Sir Philip Green, Dominic Chappell and a string of directors and advisers.

The report says the sale went ahead in a way that showed a lack of management, governance and control. Potential checks proved to be inadequate, regulatory concerns were circumvented, advisers were heavily incentivised to progress the deal and Dominic Chappell, his friends and associates were enticed by personal rewards on offer without having to take any personal risks. The Taveta group, ‘run as a personal fiefdom by a single dominant individual’, failed to provide a semblance of independent oversight or challenge.

Chappell, who took £2.6m from BHS, as well as a £1.5m family loand, was described as ‘having his hand in the till. The report said his description of £2.6 million that he personally took, in addition to an outstanding £1.5 million family loan, as “a drip in the ocean” was ‘an insult to the employees and pensioners of BHS that he let down’.

The report says Sir Philip gave insufficient priority to the BHS pension scheme over an extended period. It argues his failure to resolve its problems by now has contributed substantially to the demise of BHS, meaning he should be required to make a large financial contribution.

The report says the BHS case brings into question the adequacy of existing company law and corporate governance regulation, particularly in relation to large private companies.

The report says the future of occupational pension schemes is the greatest challenge facing longstanding British businesses and proposes a strengthening of the regulatory framework to ensure sponsor companies cannot evade those responsibilities and pass the burden onto other schemes that pay the PPF levy. The report adds ‘It is equally important, however, that a balance is found to enable otherwise viable companies to continue to operate. The jobs of those currently in employment are inevitably in some competition with the pension entitlements of their forebears. Investigating how to secure a fair and sustainable settlement will be at the centre of the Work and Pensions Committee’s ongoing inquiry’.

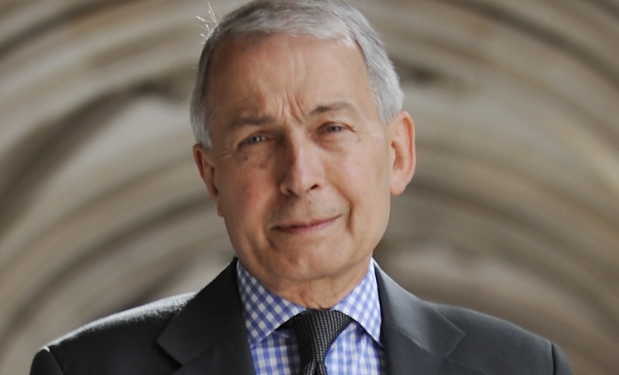

Rt Hon Frank Field MP, chair of the Work and Pensions committee says: “One person, and one person alone, is really responsible for the BHS disaster. While Sir Philip Green signposted blame to every known player, the final responsibility for up to 11,000 job losses and a gigantic pension fund hole is his. His reputation as the king of retail lies in the ruins of BHS. His family took out of BHS and Arcadia a fortune beyond the dreams of avarice, and he’s still to make good his boast of ‘fixing’ the pension fund. What kind of man is it who can count his fortune in billions but does not know what decent behaviour is?”

Iain Wright MP, chair of the Business, Innovation and Skills Committee says: “BHS’s demise has created many losers, particularly the 11,000 staff facing the loss of their jobs and the 20,000 pensioners facing significant reductions to their pensions. The actions of people in this sorry and tragic saga have left a stain on the reputation of business which reputable and honourable people in enterprise and commerce will find appalling. The sale of BHS in March 2015 is crucial to its eventual collapse a year later. The sale of BHS to a consortium led by a twice-bankrupt chancer with no retail experience should never have gone ahead; and this was obvious at the time. The reason it did, however, was Sir Philip Green. He was determined to get the deal done, no matter that the buyer could not deliver what BHS needed. There was a complete failure of corporate governance, with Sir Philip bulldozing the sale through, without proper oversight or challenge from his weak and impotent board.

“While BHS staff face uncertain job prospects and pensioners worry about their future entitlements, it’s clear that a large cast of directors, advisers, and hangers-on enriched themselves off the back of BHS, including Dominic Chappell and his fellow RAL directors. Chappell took no risk and put no money into the venture and yet gained huge rewards as BHS crumbled around him. His failure is bad enough but that he effectively had his hands in the till is an insult to the employees and pensioners of BHS that he let down so badly.”

PLSA director of external affairs Graham Vidler says: “There are over 6,000 defined benefit schemes in the UK, with 11 million members and over £1 trillion of assets so it’s important to make sure schemes are secure and working hard for both members and the wider economy. As this report highlights these schemes are operating in a very challenging environment and even the most supportive sponsoring employers find themselves making very difficult choices about how best to balance the interests of their DB scheme and the wider business which supports the scheme, its members and many other employees.

“In this case the Committee has reached a clear conclusion that the sponsoring employer was not supportive and says Sir Philip Green ‘and his directors repeatedly resisted requests from trustees for higher contributions’ to the scheme and concludes that the ‘massive deficit is ultimately Sir Philip Green’s responsibility’. This sends a welcome and strong message about employers’ duties to the millions of defined benefit pension scheme members in the UK.

“The Committee’s commitment to ‘investigating how to secure a fair and sustainable settlement’ can be reached is also very welcome, including its focus on whether the balance in the regulatory framework is correct in that it can offer both adequate protection and strong enough recourse for schemes and trustees. It is important to recognise that over the last decade employers have put a record amount of money into DB schemes generally but this has made little impact on funding levels because the challenges facing schemes are complex and varied. The PLSA’s DB Taskforce has been set up to gain a thorough understanding of these challenges and propose some solutions. The Taskforce will share its work and findings with the Work and Pensions Select Committee and we believe these will be helpful to the wider inquiry into DB schemes the Committee has planned.”