More than half a million people made more than a million flexible withdrawals from their pensions, taking £5.7bn from their pots in 2017, figures from HMRC published today reveal.

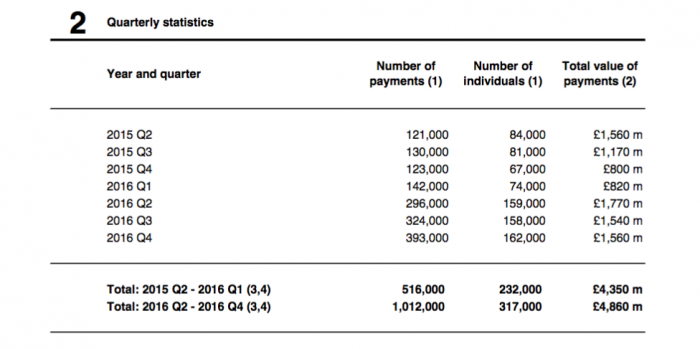

The figures show at least 553,000 people accessed pensions flexibly in 2016, although the figure could be nearer 640,000 as the last three quarters showed a steady figure of around 160,000 people accessing pension freedoms each quarter. HMRC cautions that the numbers published for 2015-16 are not comprehensive as to manage the burden on industry reporting was optional for 2015-16 but compulsory from April 2016, explaining the significant jump in numbers from Q2 2016 onwards.

Q2 2016 saw 159,000 people make 296,000 withdrawals totalling £1.8bn, while in Q4 saw 162,000 people make 393,000 withdrawals totalling £1.6bn, suggesting the impact of a trend towards smaller, more regular withdrawals.

Q2 2016 saw 159,000 people make 296,000 withdrawals totalling £1.8bn, while in Q4 saw 162,000 people make 393,000 withdrawals totalling £1.6bn, suggesting the impact of a trend towards smaller, more regular withdrawals.

Zurich head of corporate funds propositions Martin Palmer says: “Nearly two years since its inception, these figures show that those taking advantage of the pension freedoms has hit an all-time high. They also demonstrate the variety of approaches that people are taking towards their retirement.

“That said, it is essential that the pension freedoms are not simply used to boost short-term spending power, and that people are empowered to make informed choices. We know that almost half of UK adults fear a lack of savings will prevent them from realising their life goals. However, we also know that those who set specific goals for life after 65 save more for the future, and could be over £30,000 better off than those who don’t. It’s important to make the most of the support available, including potential pension contributions from employers. Likewise, making the right investment decisions is crucial – especially as retirement approaches – and is central to an overall plan.”