Annuity sales fell to their lowest level this century in Q4 2016, with 17,000 contracts put in place compared to 20,000 the previous quarter, although the value of the average fund invested climbed to £58,100.This compares to sales of 89,000 annuity contracts in the second quarter of 2013, according to FSA figures.

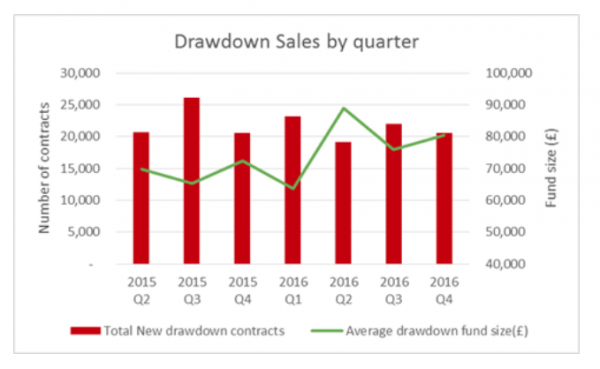

ABI data shows drawdown contracts entered into fell back slightly, from 23,000 to just over 20,000 between Q3 and Q4 of last year. The proportion of customers switching provider to buy either an annuity or drawdown product was at 50 per cent for Q3 2016.

Two years since the Government’s pension flexibility reforms came into effect, the majority of savers with larger pots are using them to buy a retirement product – either a guaranteed income through an annuity or taking flexible income through a drawdown product. The sum being withdrawn when a pension pot is taken as one lump sum the first time it is accessed has fallen to an average of £14,000, compared to £15,000 in the first year of the pension freedom reforms.

The level of activity remains high with around 170,000 pension pots being accessed for the first time during the second and third quarters of 2016 and 82,100 new products being sold.

The level of activity remains high with around 170,000 pension pots being accessed for the first time during the second and third quarters of 2016 and 82,100 new products being sold.

This compares with 87,500 new products being sold in the same quarters of the previous year. Other direct comparisons are not possible because of a change to the FCA data collection, which the ABI’s own collection is aligned with.

During the second and third quarters of 2016, the average sum being taken by people going into drawdown for the first time was just over £2,000. Previous figures, covering all customers in drawdown during the first twelve months of the flexibilities, showed average payments over £3,500, although direct comparisons are problematic because of the different bases for collection of data.

ABI head of retirement policy Rob Yuille says: “It was inevitable that fewer people would choose a guaranteed income for life if they had the option of a lump sum, but after an initial dash for cash the market is settling. While the numbers of those taking their pensions as a lump sum remains high, the average pot taken is relatively small with the majority of funds going into either a guaranteed income for life or a flexible income product.

“Flexibility is more meaningful to those who have been able to save more. Auto-enrolment has worked well to get millions more people saving for a pension. The priority now has to be increasing savings levels, and ensuring self-employed and part-time workers don’t get left behind.”