The funding, through crowdfunding platform Seedrs, values the company at £3.47m, and will go towards developing technology to enable AgeWage to generate tens of millions of value-for-money scores for consumers’ pension pots and facilitate their distribution. The funding target was originally £200,000.

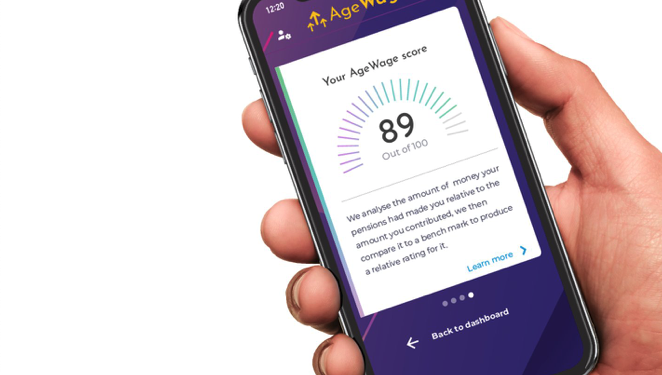

AgeWage scores pensions on a scale between zero and 100, based on its own criteria, and suggests actions, such as transfers.

The service will be available across phone, tablet and desktop and will be free to consumers.

Revenue is expected to come from referral fees for transferred pots, as well as consultancy services.

Founder Tapper says AgeWage will not have a minimum viable product until September at the earliest.

Tapper says: “A lot of the closed book pension providers, and some of those with open books, have sub-standard products. These providers want to treat customers fairly and keep them happy and we think they will want to share AgeWage scores with their customers to help them make informed decisions about their pots. So we have a migration model that helps put unhappy customers in a happy place.

“Also, some, but not all IGCs want to tell people what is happening with their pots, so we think they will engage. There are a lot of people out there who want this to work, including senior people at the regulator.”