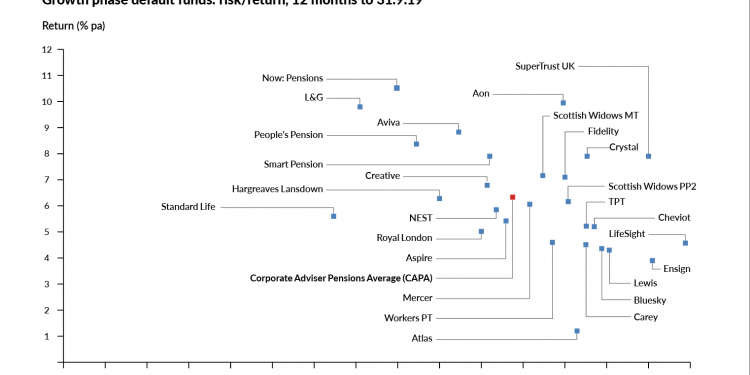

Now: Pensions, the master trust that has sat at the bottom of the workplace pension default performance tables for several years, delivered the sector’s strongest performance in the year to Q3 2019, for growth phase investors.

Now: Pensions’ default fund was up 10.52 per cent in the year to 30.9.19, more than 4 per cent higher than the Corporate Adviser Pensions Average (CAPA) of 6.33 per cent – the average return across the 30 master trust and GPP default funds that submitted data. All figures are before charges have been deducted.

To see performance for various cohorts over different time periods click here. Bar graphs contain more providers, as line graphs are only shown for those providers submitting data over all time periods.

Now: Pensions achieved this return with the third-lowest risk rating of all providers supplying data, after Standard Life and L&G. In the previous quarter its 1-year returns stood in the bottom half of the table. While any short term investment period may show significant performance variations, Now: Pensions’ sudden rise, which is not reflected across the rest of the providers in the sector, may be down to its unique in the

master trust space diversified growth strategy that allows 100 per cent derivative investments and significant gearing. Now: Pensions has said its derivative-based strategy means it is capable of making returns when markets are falling.

Now: Pensions still has the lowest returns in the sector over 5 years to 30.9.19, with an annualised return of just 5.04 per cent, more than 4 per cent lower than the CAPA average of 9.65 per cent. Standard Life’s master trust and GPP saw a return of 6.52 per cent, while Hargreaves Lansdown’s BlackRock Consensus 85 default – its principal default fund, returned 8.63 per cent.

All defaults saw positive returns for growth phase investors in the 12 months to Q3 2019, with the lowest return from the Atlas Master Trust, which returned 1.2 per cent over the period.

The top performer over five years for growth phase investors, measured by CAPA-data.com as those 30 years to state pension age, was SuperTrust UK, the master trust with a very high global equity exposure that has failed to achieve authorisation, and so will have to exit the market in the future. SuperTrust UK achieved a 5-year annualised return of 13.5 per cent over the period.

Scottish Widows’ main GPP default, its Pension Portfolio Two Pension Series 2, holds second spot for growth investors over 5 years, with a 5-year annualised return of 10.41 per cent.

Over five years Standard Life’s default took the lowest level of risk, followed by Legal & General, Royal London, Hargreaves Lansdown and Now: Pensions.

To see risk/return scatter graphs and data on providers’ defaults over various time frames, for various investor age cohorts, go to www.capa-data.com/performance