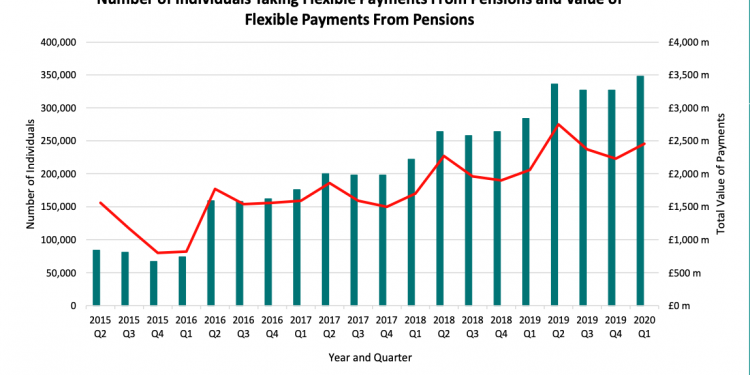

More than £35bn has been withdrawn from pensions since freedoms were in 2015 with £2.5bn withdrawn in Q1 2020, up 19 per cent on the same period last year.

The £2.5bn represents a record withdrawal for Q1, although it is below the £2.7bn peak seen in Q2 2019. Withdrawal numbers typically rise in Q1, before peaking in Q2, as this coinides with the beginning of a new tax year. This seasonality comes as some individuals access their pension over a number of years and often use the flexibility to withdraw funds at the beginning of the tax year.

Q1 2020 saw a record 348,000 individuals withdraw from pensions, a 23 per cent increase from 284,000 in the same quarter of the previous year.

But there has been no early coronavirus dash for cash says Aviva head of savings and retirement Alistair McQueen, who says the figures show customers are generally following the guidance to focus on the long term.

The average amount withdrawn per individual in Q1 2020 was £7,100, falling by 3% from £7,300 in Q1 2019. Since reporting became mandatory in Q2 2016, average withdrawals have been falling steadily and consistently, with peaks in the second quarter of each year becoming a noticeable trend, says HMRC.

McQueen says: “Q1 typically sees an increase in withdrawals, as people approach the tax-year end. This year, the first quarter saw a 10% increase in total withdrawals, compared to Q4 2019. This is lower than the 13% increase witnessed in Q1 2018, and only marginally up on the 8% increase in 2019, suggesting no significant early change of behaviour in response to coronavirus.

“This is good news. Aviva has been encouraging its customers to keep calm, focus on the longer-term and seek help from services such as the government’s Pension Wise service. Today’s figures give early confidence that this guidance is being followed.”

Aegon pensions director Steven Cameron says: “There is a big question over how the use of pension freedoms will be affected by the coronavirus crisis, both in terms of challenges to individuals’ financial positions and recent and likely ongoing stockmarket volatility. Future data should help us gather a fuller picture of any changes in behaviours

“For those facing financial difficulty, pension freedoms offer flexibility to ease financial burdens in uncertain times, such as those we are experiencing today. However, freedom comes with great responsibility and it is crucial that people understand the risks associated with drawing down their retirement savings which for many need to last a lifetime. For many, it may be better and more tax efficient to use other sources of savings first.

“The coronavirus and ensuing market volatility highlights the risks involved and we encourage individuals whether considering or in drawdown to avoid panic measures and to seek financial advice or guidance before making important decisions.”

Hargreaves Lansdown interim head of policy Nathan Long says: “It is important to note that the number of people using pension freedom is being added to every year, as successive cohorts reach retirement, so you’d expect the withdrawal values to increase year on year; these numbers are in line with that trend. However, investors should be especially mindful at this time of cashing in investments after significant market falls and for some, it may make sense to hold back until the present economic turmoil subsides. We’ve seen some early evidence of drawdown investors scaling their withdrawals back slightly during the Coronavirus inspired market falls.

“If this proves to be a false dawn and withdrawals continue to rise through the second quarter of 2020 that could be a warning sign of long-term damage being done to people’s retirement savings.”