Fast-growing Sipp technology provider Gaudi is launching a white-labelled pension drawdown product targeting fintechs, advisers, stockbrokers and platforms.

The provider has been offering Sipp technology and FCA-regulated wrappers for 10 years and current clients include advisory firms such as Foster Denovo, trading platform Freetrade, and fintech startups including Moneybox and Penfold.

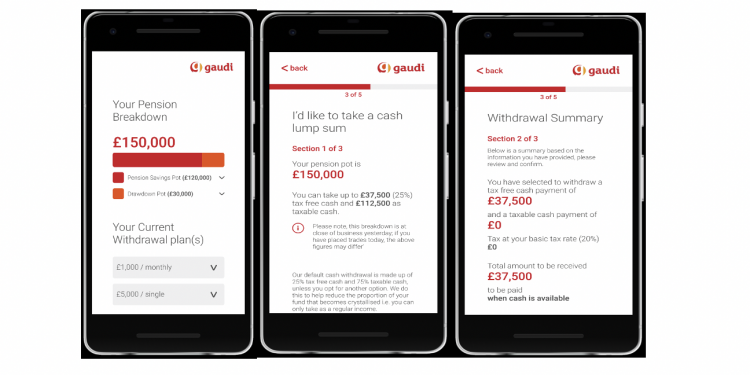

The product offers a real-time link to payroll that enables drawdown users to specify a precise amount they can withdraw after tax.

Gaudi new business volumes have increased more than 10-fold in the last year, now administering over 24,000 Sipps through these relationships, putting it in the top ten of Sipp providers.

The proposition is available either as part of Gaudi’s white labelled Sipp or as a plug-in to other pension providers, whether B2C, intermediated or in the workplace.

The Gaudi offering has all pension drawdown options including taking all the tax-free cash and no income and allowing ad hoc or regular withdrawals from tax free or taxable funds.

Planning tools are available through smart devices branded to Gaudi’s business partner brand.

Gaudi managing director Patrick Vaughan says: “Having over 24,000 Sipps under our administration makes it a natural progression to offer a drawdown proposition. We are acknowledged experts in electronically linking to a provider’s customer facing systems with the administration platform to speed every aspect of the process from application to taking regular money out.

“Today’s customers expect Straight Through Processing achieved through mobile devices not just for their banking but all their finances – including their pensions. Gaudi provides a combination of flexibility, service and competitive price for a market leading white labelled pension drawdown that delivers real value for money”.

Gaudi head of technical and compliance Robert Graves says: “Pension drawdown is the foremost tool in tax efficient retirement planning, but it can represent a risk for the unwary or inexperienced of getting it wrong. This is where Gaudi’s technically accurate and compliance assured technology comes into its own by producing outputs that are fully fit for purpose and in accordance with the complex rules. My team will ensure for any white labelled SIPP or pension drawdown everything is compliant and technically correct”.