The US faces structural, legal and political challenges if it wants its workplace pensions to embrace the ESG strategies that are starting to become more widely adopted in the UK and Europe.

CLICK TO VIEW ALL THE VIDEOS FROM ALL THE ESG FORUM SESSIONS

Speaking at the Corporate Adviser ESG Forum, David C John, senior strategic policy advisor, public policy institute, American Association of Retired Persons set out the challenges faced by the pensions industry.

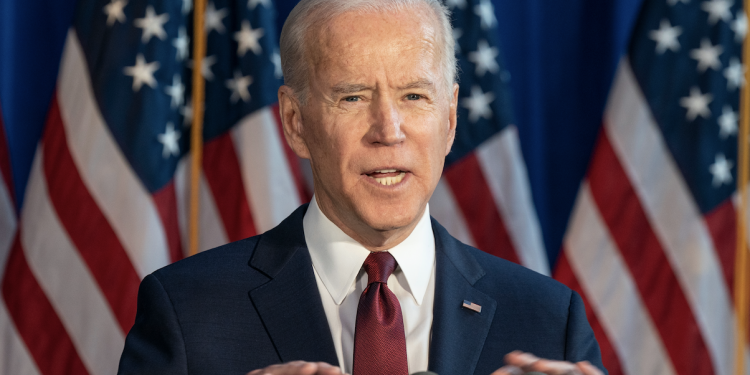

He pointed out that the incoming Biden administration was a positive force, and that steps had already been taken to unroll some of the legislation introduced at the end of Trump’s term, which explicitly restricted ESG investments.

He says Biden had made clear his commitment to tackling climate change, and has set up a climate risk unit in the Treasury department and at the Federal Reserve.

However he said potential legislation by individual states – such as Texas and West Virginia – and the lack of a Democratic majority in the Senate could impede progress.

John pointed out that the Republicans on the Senate Banking Committee had recently written to the Federal Reserve Board questioning the purpose and efficacy of climate-related banking regulation.

Meanwhile Texas has tried to impose legislation that would ban pension funds from investing in any companies that proposed, or even considered the possibility, of divesting from energy stocks.

He added: “Pension funds find themselves in the position where they can be sued by one group because that are working on the climate issue to quickly, and at the same time be sued by another group because they are working on climate issues too slowly. Pension managers certainly find themselves in a tough spot at present.”

John describe the previous Trump administration as ‘hostile’ to ESG investment strategies, and attempts by the broader investment industry to restrict and reduce climate change. Legislation introduced in the final months of the administration ruled that pension funds were not meeting their fiduciary responsibilities to members if they brought in additional factors other than investment returns. This would include ESG considerations.

Other restrictions prevented pension funds voting on company issues that did not directly affect financial issues. John also pointed out that the legislation explicitly ruled that any fund whose investment goal, principle or objective included one or more non-pecuniary factors – such as an ESG strategies – could not be a default strategy within a workplace pension.

Biden administration has acted to change this he says, and will not enforce this legislation. However John says there is likely to be an “extended process” where these issues are reviewed and new regulations issued.

John said he broadly agreed with the assessment made early int he day by the UK pensions minister Guy Opperman that the UK and Europe had “first mover advantage” when it came to ESG-related investment expertise. However he did not rule out that some ESG nationalism may come into play. He said once the political and regulatory situation changed “investment companies will be ready to move. And we will see how long that advantage lasts.”

He adds that there was growing demand from US investors for more sustainable investment opportunities within workplace pensions. “Hopefully three or four years from now we will be having a similar debates and conversations about ESG in workplace pensions that are happening elsewhere.”