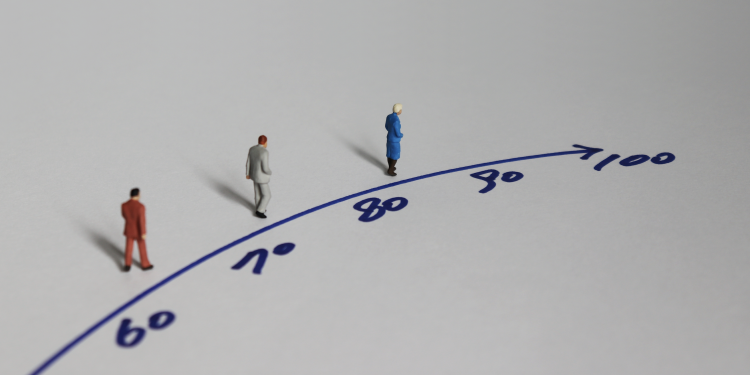

The government has launched a second review of the state pension age to determine what evidence-based indicators should be taken into account when setting the age of entitlement in the future.

The government has commissioned Baroness Neville-Rolfe DBE CMG to write an independent report on what indicators should be considered when determining the state pension age in the future.

The independent report will be informed by the information gathered through the request for evidence. Experts in longevity and ageing, older people and the labour market, intergenerational equity, and budgetary issues related to an ageing population are encouraged to contribute.

But plans to raise the state pension age to 67 by 2028 and 68 by 2039 have been criticised because changes will affect life expectancy in different ways across the UK.

According to research from LCP, if the government sticks to its policy of linking the state pension age to life expectancy, as projected by the Office for National Statistics, there would be no reason to raise the pension age from 66 to 67 until 2051 – 23 years later than planned. This change would cost the Treasury at least £195 billion in planned state pension savings while giving over twenty million people born in the 1960s, 1970s, and early 1980s a state pension age ‘reprieve.’

The second state pension age review, according to some industry experts, “will inevitably be controversial” because the proposed changes will have varying effects on life expectancy, impacting segments of society differently.

Canada Life technical director Andrew Tully: “Any debate around the increase to the state pension will inevitably be controversial. Life expectancy varies hugely across the UK so any change isn’t straightforward. People living in poorer areas are also much more likely to remain in work while waiting to become eligible for the state pension, so any change will inevitably have a more fundamental impact on some. That being said, allowing access at different ages would be extremely complex.

“All in all there are no easy answers and it needs to form part of a wider debate around levelling up, increasing life expectancy across all regions in the UK, and increasing private pension savings through auto-enrolment. Clear communication of any proposed changes will be essential for success, ensuring people understand how they will be impacted and with plenty of time to plan for their future.”