High-profile consumer champion Martin Lewis is urging savers to review and update their pension beneficiaries, cautioning that failure to do so could result in a pension being inherited by an ex-partner.

During a television segment on “pension secrets,” Lewis highlighted a common misconception that many people assume pensions can be passed down in a will. He clarified that trustees are the ones who decide where the money goes but emphasised that people can nominate a pension recipient using an expression of wishes or a nomination form provided by the pension provider.

Lewis said: “The important thing is to use an expression of wishes form or a nomination form, which your pension provider usually has on their website. This form tells the trustees who you would like the money to go to. While you can’t dictate the outcome, it is a very strong indication of your preference.

“My big tip: If you haven’t done this recently, or have never done it, make sure it’s up to date because you do not want to leave your pension to your ex. People often update their wills but neglect their expression of wishes forms.”

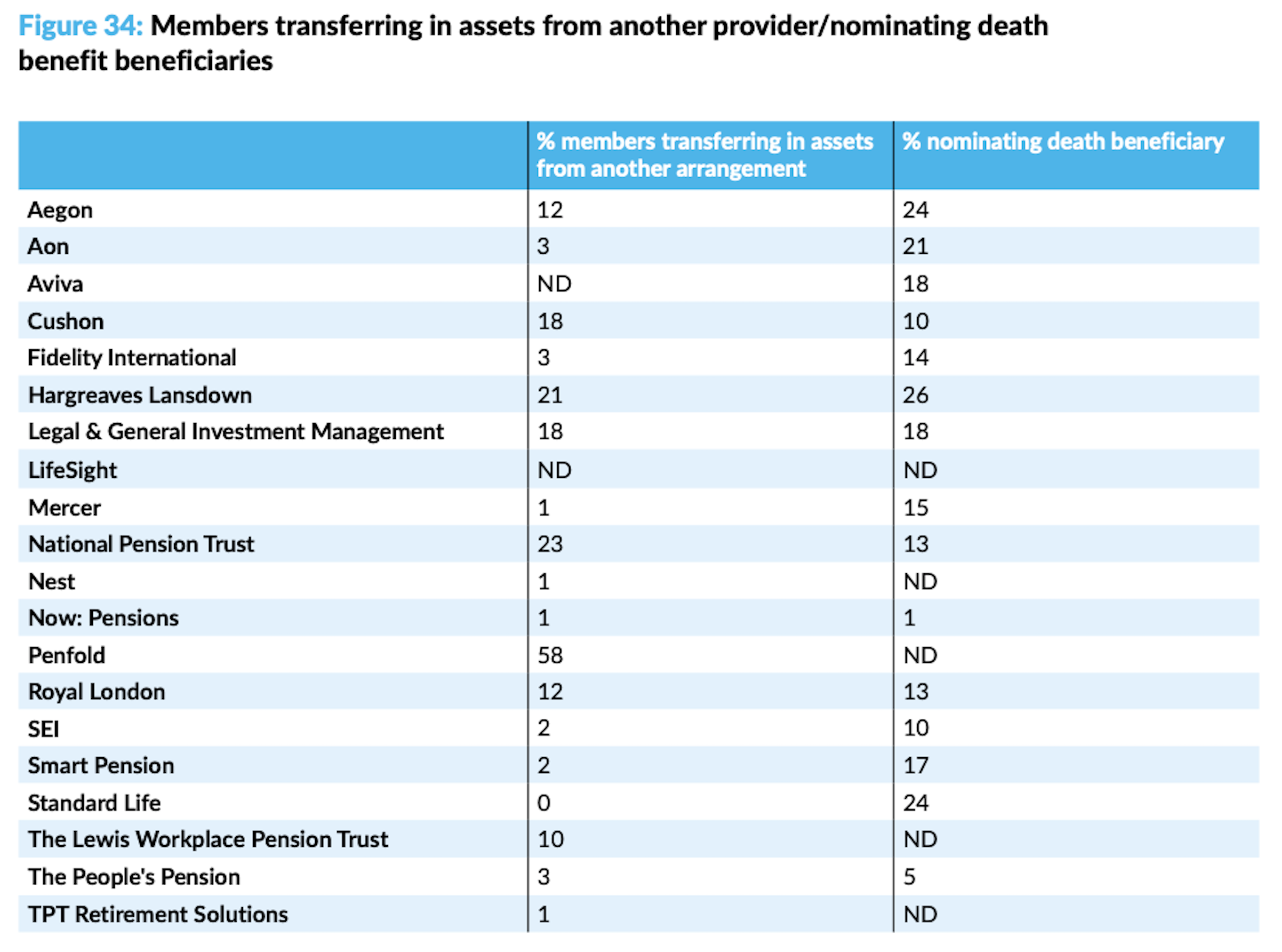

Corporate Adviser’s own research, as part of its Master Trust & GPP Defaults Report 2024, shows that most providers have very few members nominating their death beneficiaries. It found that Hargreaves Lansdown has the highest proportion of DC savers nominating their death benefit beneficiaries at 26 per cent. This is closely followed by Standard Life and Aegon at 24 per cent, Aon at 21 per cent and LGIM, Smart and Mercer at 18, 17 and 15 per cent respectively.

Nest is the biggest provider not to disclose what proportion of its members have nominated a beneficiary.