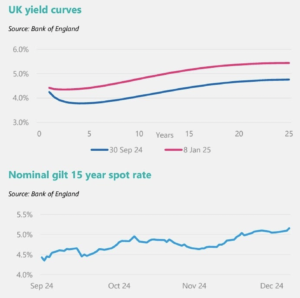

Over the final quarter of 2024 and into 2025 UK gilt yields have risen steadily, with the 15-year nominal (spot rate) yield increasing from 4.43 per cent as at 30 September 2024 to 5.16 per cent as at close on 8 January 2025. The movements have been relatively consistent across all durations, with a slightly larger rise at the long end of the curve as can be seen in the charts below.

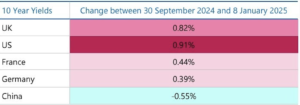

This is not a UK specific issue. Global yields have followed a similar pattern as shown in the table below, over the past 3 months:

Underlying causes

Whilst you have to be careful not to artificially fit a story to market moves, we feel the rise in yields set out above can mainly be attributed to increasing concerns about the size of government debt levels and, crucially, their future trajectory. In particular:

- Uncertainty following the US election. The prospect of trade tariffs, tax cuts and a clampdown on immigration by the incoming Trump administration are likely to drive up inflation in the US and globally. Questions also remain over the potential replacement of Jay Powell as chair of the Federal Reserve.

- This expansionary fiscal policy is not just a US issue. The UK budget in late October also saw an increase in government spending and introduced a number of measures, including tax and wage increases, that are expected to keep inflation above the Bank’s 2 per cent target, at least in the short term.

At a time when central banks are undertaking Quantitative Tightening (QT, selling government bonds back to the market), the prospect of further debt issuance from major economies on the back of governments’ fiscal policies has made markets nervous. The combination of these factors has resulted in markets becoming increasingly uncertain on the path of interest rate cuts. Whilst this was a factor in gilt yield moves throughout September and October, changes to the market’s view on the future path of rates have been minimal during the last month or so reinforcing our view that international factors appear to be the most significant contributors.

Exchange rates

As yields have risen there has also been a significant movement in exchange rates. Sterling has fallen by 8.7 per cent against the US dollar since 30 September 2024, yet remains broadly unchanged against the euro and other currencies. We therefore see this more as a strong dollar story – with markets anticipating Trump’s economic policies – rather than weak sterling.

Market view for institutional investors

We believe the recent yield movements are largely an overreaction to global political uncertainty. Although global fundamentals have shifted towards a more inflationary environment, the UK economy has relatively weak growth prospects and interest rates are still set to fall. Markets still expect two rate cuts from the US Federal Reserve and Bank of England over 2025, a position largely unchanged over the past month despite the significant yield rises.

We believe gilt yields will fall over 2025/26 as the Bank of England unwinds their current restrictive stance and will eventually reach a level consistent with the fundamentals of the UK economy, i.e low growth, lower inflation. We do continue to expect that inflation will remain stubbornly above the 2 per cent target in both the short-term and medium-term and so rate cuts may well be pushed to later in 2025 and into 2026.

The uncertainty set out above is not suddenly going to be resolved and so this could well leave gilt yields at an elevated, and volatile, level over the early part of 2025.

What about DB pension schemes with LDI mandates?

Given the global movements and pace of the shift, we do not believe the current situation is akin to that experienced in September 2022 during the gilt-crisis on the back of the Truss-Kwarteng budget. However, we do not believe schemes should be complacent. We recommend schemes review their collateral adequacy and ensure they can withstand further yield rises from their current, elevated, levels.