Nearly one in four or 23 per cent independent financial advisers are planning to introduce AI tools into their services over the next year, according to Opinium.

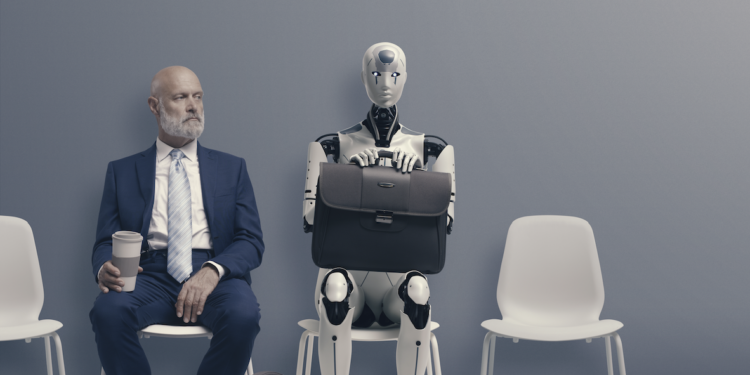

AI is slowly picking up pace in financial advice but most independent financial advisers (IFAs) are hesitant about it. Just 14 per cent of advisers using AI tools, while the majority, around 64 per cent, have no plans to adopt AI in the next year.

Meanwhile, over half or 56 per cent see it as an opportunity while 27 per cent view it as a risk. But many are on the fence with 57 per cent don’t think AI will make much of a difference to their own firm, and 45 per cent say the same about its impact on the wider industry.

While there’s no rush to embrace AI, the survey highlights a slow but steady interest in how technology could reshape how advisers support their clients.

Opinium global head of financial services Alexa Nightingale says: “Slowly but surely, IFAs are adopting AI within their practices, although the majority of the industry still has no intention to utilise AI tools. IFAs remain divided as to the benefits of AI, and while some are cautious about the risks, it’s encouraging to see over half of advisers viewing AI as an opportunity.

“AI has the potential to support with admin and reporting tasks, streamline processes and more, giving advisers more time to deliver more personalised advice to clients. Embracing these technologies can help firms stay ahead of the curve, and help advisers deliver a better service to existing and new clients.”