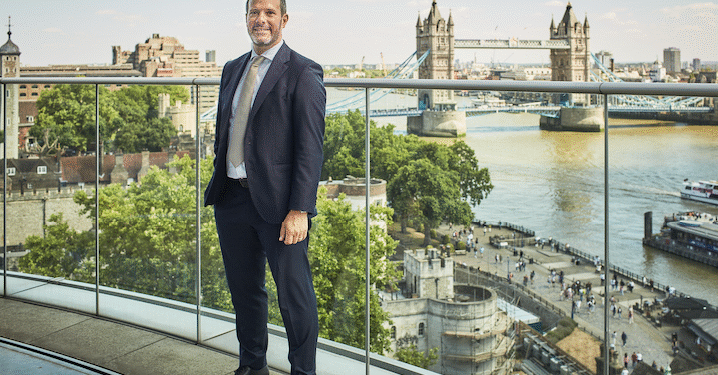

If you were looking for someone in the UK to give you an informed view as to whether DC pension schemes should be investing in private markets, Benoit Hudon, CEO of Mercer UK would probably be near the top of your list. Heading up a firm with a huge list of DB clients already investing in private markets, and hailing from Canada, home of the Maple Eight, he is firmly in the camp that believes the Mansion House Accord is a good thing.

“It’s a very welcome change in terms of mindset. We will see what the adoption rate will be and the pace of adoption, but in terms of the principle we absolutely welcome it. There are a number of contributing factors to adequacy. But in terms of how you invest, when it comes to private markets, the historical data shows us that it provides an opportunity for greater returns with different characteristics,” he says.

While all the noise around private markets relates to DC, for Hudon the UK DB world could use these assets more widely – pointing to significantly higher allocations in the US and Canada. He points to the UK government regulation incentivising 80 to 90 per cent gilt allocations as an obvious reason why the DB sector, which holds more assets than DC, is not benefiting as much as it could be from private markets.

Hudon has however been vocal about the need for a pipeline of investable opportunities if the government’s grand scheme of getting UK pensions to pay for UK investments is going to work. “If all of a sudden you want to take a couple of hundred billion and deploy that into UK infrastructure projects, if everyone’s trying to access the same investments at the same time, it will just put the price up. So there is a question of giving us time to get there.”

While he and his family are UK citizens, his upbringing in francophone Canada gives him an ability to see the way our market operates from the outside. “I’ve been in the pensions industry 30 years, but only the last 10 years in the UK. And there’s a stark difference in how funds are run here and managed versus what you would see elsewhere.”

He speaks of a UK mindset that is about running DB pension schemes in a way that is preparing them for a risk transfer to an insurance company, an approach that was eschewed in the DC world some time ago in favour of a more aggressive approach. He describes the UK as being too conservative: “To get through gilts, reducing volatility of your surplus deficit, as opposed to growing your way out of your deficit through investment returns.”

He sees the professionalisation of the trustee industry as useful here. He thinks that DC is “unfair to leave individuals on their own with no real products available to them”, to help with the decumulation challenge and its inherent risks.

He says there are structures that preserve the positive benefits of individual DC but couple that with targeted pooling and collectivism. He also points to variable lifetime annuities that exist in Canada, where the University of British Columbia has a solution in place that welcomes retirees from other funds.

Provider scale

He does not believe the scale threshold proposed by the government will stifle innovation. “By the way we have £25bn already at the moment. Not in a single arrangement, but in the Marsh McLennan family, with the Now: Pensions acquisition, and a large number of own trusts that are looking to move faster to master trust. So when you aggregate it we are £25bn.”

He doesn’t think a £10bn threshold by 2030 is anywhere near unreasonable. The UK DC sector is heading for £1trillion in the next three to four years. “If you have a trillion pounds of assets and you’re saying you need £10bn to play in this place, that doesn’t seem unreasonable to me,” he says.

Two master trusts

The firm owns both the Mercer Master Trust and Now: Pensions, acquired with the purchase of Cardano, will we see a merger of the two?

“Now: Pensions targets mainly auto enrolment SMEs, small medium enterprises. The Mercer Master Trust has clients of all sizes, but tends to be aligned to our client base, which will be larger organisations of a few hundred people and more. But at the end of the day, does it make sense for us to keep two arrangements? There’s an analysis to be done. We are in no hurry. If it makes sense to consolidate them over time you would expect us to consider whether to.”

Market consolidation, across DB and DC, is for Hudon a necessity, despite the fact that it will probably shrink Mercer’s client list in the long term. “Consolidation may mean less clients, but that is the way the tide is going. And it changes the nature of the work we do with our clients towards a greater degree of sophistication. Dealing with larger asset owners who tend to have in-house resources, more knowledge internally, forces us to also up our game and deliver advice and solutions that cater to their needs.

Broader purpose

I meet Hudon just after he has come from a meeting with Chancellor Rachel Reeves and the Ministry of Defence where he has been helping explore how pension funds can play a role in supporting the government’s many pressing priorities.

“So we’re trying to help with that. As CEO of the UK operation our marketing department will say elevate the brand. I say reposition the firm for the greater good of society, which sounds very grand, but we bring unique expertise to this market.

“There’s a point where the numbers become so big that they’re even difficult to comprehend. There’s a savings gap – people aren’t saving enough for later years. Population ageing – 80 per cent of anyone’s health care costs will be anchored in the last eight years of their life. Take life expectancy of 83. Once you’ve made it to retirement, it’s 80 to 83 years old, that means from 75 onwards, you’ll on average, face 80 per cent of your lifetime health care costs in that short period of time.

“We might think the bill was high for NHS, but we haven’t seen the end of it yet. We are not talking £2bn or £3bn. We’re talking tens of billions of pounds. The NHS is a bit of a sacred cow. But we’ll need to have an honest conversation about it,” he says. “My firm doesn’t want me to use ‘duty’ as a word. But as a CEO and leader of a team of over 2,000 professionals who can help on those issues, I think collectively we have some sort of duty to help beyond commercial interest. And I’m sure at some point it will link to commercial interests down the road. But we have a big issue as a society, as a taxpayer, and I have every vested interest in trying to help,” he says.

AI, advice and guidance

Mercer has pioneered innovation in the at-retirement space with its Destination Retirement tool, which looks at the entirety of a retirees’ assets, not just a single pension pot. So where could AI take this sort of approach?

“Three years from now, the way advice is delivered will be different. It may not be every player that has adopted it for whatever reason. But five years from now, it will be the norm in the industry,” he says.

So what about the role of consultants as AI enters every part of the value chain? “Everything in consulting will fundamentally change. Lawyers, actuaries, AI strategy consultants, management consultancies. I can’t think of any area of consulting that won’t be disrupted with AI,” he says.

So will this mean less jobs? “I think it’s just different jobs. And we’ve been there before with these big revolution cycles. They’ve just changed the nature of work. So maybe less actuaries, more AI promoters.”

Actuary by chance

While his job requires constant analysis of risk and statistical likelihood, his entire career came down to a single 50/50 call – tossing a coin to decide whether to follow in his father’s footsteps and do management science, or take up actuarial science. “I ended up an actuary at the flip of a coin. I’m glad I did because doing what my dad did would have been too easy.”

House mix

It has taken him from his native Canada to the UK which he and his family, which includes four children, now calls home. “I’ve been more into speedskating and ice hockey than football and cricket, so there is a bit of a gap,” he says. But apart from ice-based activities, his personal passions include a lot of travel – 60 countries and counting to date – and also music, where he records melodic house on his SoundCloud channel. Don’t expect him to be headlining at industry dos any time soon – he swerves performing at public music events. “But with the family, when we have a party, it’s guaranteed I’m going to the deck.”