The state pension should be radically reformed to ensure it remains financially sustainable — with big increases to the SPA, but targeted support to protect those with lower life expectancies, according to proposals from LCP.

The pension consultancy wants to see the SPA raised by one year every decade to ensure this state benefit is paid for an average of only 20 years.

It says such an adjustment is needed after “massive” increases in life expectancy over the 20th century.

However, in order to protect the interests of those living in areas such as Blackpool or Glasgow, with far lower life expectancy, LCP proposes that the state pension offers a ‘guarantee period’ to everyone, where a payment would be made to the estates of those who die within a five year period. LCP says this would ensure everyone (or their estate) gets at least this minimum sum.

These proposals come in response to the Government’s consultation on increases to the SPA. LCP says there has been some interest from Government about these proposals.

LCP says this radical reform would help “square the circle” between the need to increase pensions ages, without penalising those whose life expectancy is much lower than average.

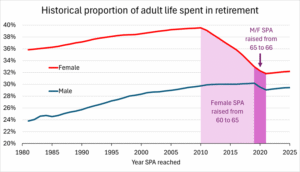

Its proposal states: “One key measure used by the Government to assess the sustainability of the state pension is the proportion of adult life people are spending in retirement. The LCP paper shows that this proportion has been going up, especially given the lack of upward movement in state pension ages for the whole of the 20th Century.”

It points out that this rise was checked by the increase in women’s pension age from 60 to 65 between 2010 and 2018, and then the increase to SPA for both men and women to 66 in 2020. But it points out that the length of the average retirement has already started to grow since then.

The paper says that the Government’s original plan was to set state pension ages so that people could expect to spend up to one third of their adult life in retirement. But LCP argues that “locking in” these historically unprecedented levels of retirement would be financial unsustainable.

Instead, it argues the best way to put the state pension funding on to a firmer footing would be to set SPAs so that people could, on average expect to receive a state pension for a fixed period, such as 20 years. It says this means that as life expectancies improve, retirements will stay the same length but working lives will gradually lengthen, thereby making the system more affordable.

It says offering a guarantee five year period, to those who die far sooner would not add greatly to the cost of the pensions system, as most people draw pensions for longer than this.

LCP partner and longevity specialist Stuart McDonald says: “Life expectancy in the UK for young adults rose by 17 years during the 20th Century, but the state pension age did not increase at all.

“As a result, we now have historically long retirements which will inevitably prove fiscally unsustainable. A new approach is needed. We recommend setting pension ages on the basis that the average person can expect a fixed number of years in retirement. This will help the system to catch up with the dramatic improvements in life expectancies which we have seen, and will be fairer to current and future people of working age, whose contributions are used to pay the pensions of retirees”.

LCP partner and former pensions minister Steve Webb adds: “The case for increasing state pension ages is strong, but it has always been hard to do so in a way that is fair to people in more deprived areas who cannot expect to draw a pension for as long.

“Our proposal for a guaranteed minimum payout period of five years represents a ‘something for something’ reform. Those who have paid in to the system all of their lives would be guaranteed that they or their heirs would get a minimum payout once they start drawing a pension. This would be a concrete way of addressing concerns over unfairness each time state pension ages are increased”.

LCP note that there may also need to be corresponding reforms to working age bereavement benefits, so those who die before reaching pension age would also get ‘something for something’.