Professional trustees are concerned that their role will be undermined by Government pension reforms, with specific concerns about reserve powers to direct DC investment decisions.

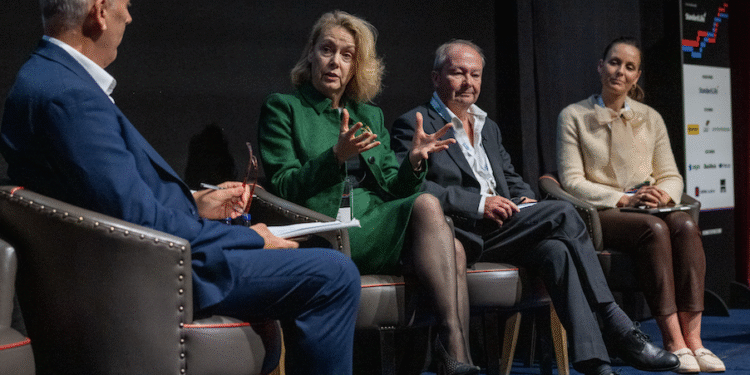

In a panel debate at Corporate Adviser’s Master Trust and GPP Conference three professional trustees expressed their deep reservations about this element of the Pension Schemes Bill, which gives the Government the right to mandate that schemes invest a set portion of their default funds into certain assets classes.

Helen Dean, chair of the Standard Life Master Trust Board and a former CEO of Nest said that investment decisions should “always be driven by member need” and there is a danger this potentially over-rides this.

She also cited other concerns with this part of the legislation. “There is the risk it interferes with the efficiency of markets”. She pointed out that larger pension funds have been able to negotiate prices downwards in private markets, but if schemes are obliged to invest fixed amounts into certain asset classes this could hamper this process.

“There is also a risk for Government. If there is a period when an asset class underperforms, which will inevitably happen, and it is mandatory for schemes to hold invest in this areas, then the pressure to offer compensation to savers will be enormous.” This is a potential risk to government, and ultimately taxpayers she says.

Dean adds: “Personally I think it will be ill-advised for government to enact these reserved powers of mandation contained in this Bill.”

Capital Cranfield professional trustee Andrew Cheseldine said he agreed with all of her points. “I can’t believe any politician would want their fingerprint on this,” he added

He also pointed out that while this provision has been included in the Bill due to the Government wanting schemes to diversify into private assets, including UK-based opportunities, the way the Bill is worded could allow future government to include other assets or stipulate higher investment limits.

While he said he does not object to DC investments into private markets, this should be the trustees’ decision, based on the interests of their membership.

Vidett head of trusteeship Alison Hatcher said it was “very disappointing that we’ve ended up here, and so quickly too.” She said there has been a lack of discussion with trustees up to now, though she said she remained confident that their voice was starting to be heard.

Hatcher agreed there was a positive case to be made for greater DC investment into private assets. She said she supports investment into projects like local housing, which can deliver returns for investors and broader benefits for members, in terms of affordable housing to buy and rent.

“It is possible to get good returns from smaller more locally-invested funds that can deliver a real impact,” she added.

The panel discussed the point of view that the Government gives generous tax relief on pension contributions, so should be able to require schemes to invest at least a portion of these funds directly into the UK economy. This was a view that has been put forward by a number of former pensions ministers, including Guy Opperman and Ros Altmann.

But Dean says she strongly contests this premise. “This is not government money. It is members’ money and decisions should be made on their behalf.”

But while there was consternation about this particular part of the Pension Schemes Bill, the trustees welcomed the broader direction of travel. Dean said the drive towards consolidation across the industry would likely facilitate more investment into private markets — hopefully negating the need for the government to activate these reserve powers.

Other topics under discussion included the new value for money regulations. Dean said that while this was broadly welcomed there was a danger that it could “erode” the power of trustees if this lead to herding, when it came to investment decisions.

The panel also discussed potential conflicts of interests faced by the profession. Cheseldine says there may be concerns when professional trustees are effective “rubber-stamping” a range of additional services offered by their company to the scheme.

Hatcher though pointed out that most trustees were aware of any potential conflicts, and should have well-thought through process to identify and deal with these issues, should they arise. Such governance issues are part of a trustees took-kit she said, that are dealt with frequently.

Hatcher added that she welcomed the regulation of trustees but did not think it would make a significant different to day-to-day activities.

Cheseldine agreed and said fiduciary duty as it stood was working well and he hoped the government would recognise the valuable role trustees played protecting members’ interests.