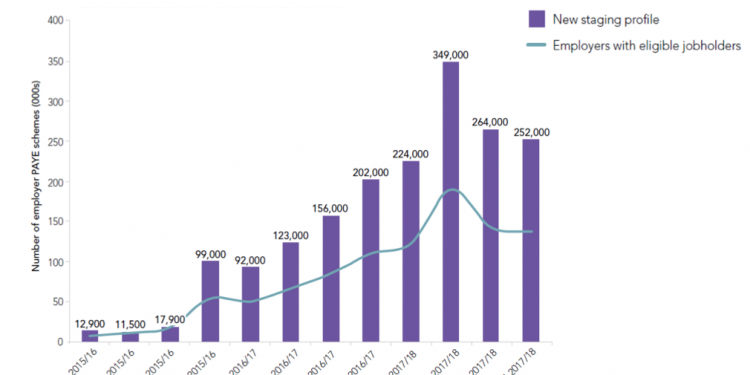

Titcomb said just 3 per cent of the UK’s employers had passed their auto-enrolment staging dates, and warned advisers to be ready for the hundreds of thousands of businesses that would need to comply in the next 12 months.

“Our research shows us that many employers will approach their business advisers relatively late in the day, perhaps two months ahead of their staging date or later. My message is to be ready and well prepared, and to start early,” said Titcomb.

Titcomb urged advisers and providers to have a ‘clear idea’ of the services they plan to offer and to know their clients’ staging dates.

Advisers attending the summit were optimistic about the impact of a spike in auto-enrolment in 2016, with 43 per cent saying they see next year as presenting a significant opportunity to their business.

Just over a quarter – 27 per cent – say it is a small issue for their business, while the remaining 30 per cent consider next year’s enrolling employers as outside their target markets.

Titcomb said TPR had improved its support and advice materials for employers and advisers.

In particular the regulator is launching an online step by step guide for small and micro employers which will be available later this month.