[SPONSORED CONTENT]

There is a lot going on in the advice space. Between the polarised concepts of Guidance and Full Advice, we know from the FCA’s recent consultation paper (CP25/17), that the vision of the future is for two additional services sitting in between.

The first, ‘Targeted Support’, is described as a new concept, although this is pretty much the choice architecture already used for investment pathway conversations. We therefore already have a lot of live and real-world data on the take-up and effectiveness of this type of customer interaction.

The second, ‘Simplified Advice’ already exists and also sits within the broader arenas of the ‘Core Advice’, ‘Streamlined Advice’ and ‘Robo Advice’ discussions. Bringing all of these regimes and concepts together into a proposal that can be consulted on in January looks interesting.

The idea seems to be to create a continuum from guidance, through targeted support, on through simplified advice and finally on into full advice, where customers, including pension members, of course, can engage with the financial services industry at any point of their choosing and migrate up or down that continuum as required. This could include hand offs between firms.

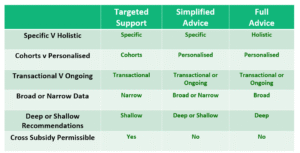

I’ve been trying to make sense of how each of these might work alongside each other as part of that continuum, and in doing so believe that there are six key attributes which together define the concepts and facilitate comparison.

The Continuum (Comparisons)

Simplified advice is likely to share the characteristic with Targeted Support of being applicable to a specific situation or question. This makes the customer interaction simpler than is the case with full advice, and both therefore lend themselves well to digital solutions and reduced cost. Both would almost certainly be developed and delivered by providers in the course of their ongoing dialogues with existing customers.

From conversations I’ve had with Independent Financial Advisers (IFAs) around the UK over the last few years, I don’t expect these two services to be developed and deployed by those firms. They have some worries that a service which is less holistic will dilute their brand, and also create customer confusion between the different offerings, which they fear might have implications for liability and redress in the future.

Preference for personalised approach

Simplified advice, however, is likely to share the common characteristic with full advice solutions by being personalised, whereas targeted support solutions will be cohort based. Our research tells us that customers would prefer something that is more personalised, so does simplified advice then gazump targeted support?

Well, no. Simplified advice is also expected to share a common characteristic with full advice in requiring a specific customer charge to be levied for the service. It’s likely that the application of technology will greatly reduce that charge but in our experience, even tens of pounds would disrupt the customer journey to the extent that is will be non-viable.

Customers who don’t make use of full advice fall into two broad camps:

- Those who can’t pay.

- Those who won’t pay.

Overcoming friction points

Simplified advice journeys need to be digital, and for digital journeys to work they need to be friction free. Our research and experience tells us that introducing a monetary charge is just about as much friction as is possible to introduce, and people will drop out of the journey at that point.

Irrespective of the level of friction, many will simply refuse to pay on the grounds of principle. They expect experts within firms with whom they have an existing commercial relationship to share that expertise when they need support in making decisions. That’s what happens across the other complex industries with which customers engage.

In my view, the requirement to charge for advice may be a barrier to many, so the funding aspect will need to be considered carefully if this is to be a viable proposition.

All three forms of support can be designed to be transactional in nature, but it’s only simplified and full advice which would likely be designed as an ongoing service. The nature of targeted support really requires that it be a one and done at a point in time.

In terms of the breadth of data that needs to be gathered and the depth of the recommendations that could be made, it’s possible that simplified advice could be a continuum of propositions between the polarised positions of targeted support and full advice, with different firms developing broader or narrower propositions based on their business model and target market and customer base.

We can’t ignore the role that AI is likely to play in all of this too, and helping people to get support that is right, and appropriate.

We now know a lot more about what targeted support looks like. We’ll know a lot more about simplified advice early next year, and we should remember that the FCA’s work on ‘Ongoing Advice’ within full advice continues.

Do we know enough of the final picture to place our bets on what the outcome will be? We see a role for targeted support, whereas the role and potential uptake of simplified advice is as yet unclear.

Read more on the Scottish Widows content hub or for more expertise and thought leadership from Scottish Widows’ workplace pensions experts visit – here