Employers see the ease with which they can set up their auto-enrolment scheme as considerably more important than the scheme’s investment approach according to new figures from Pension Playpen.

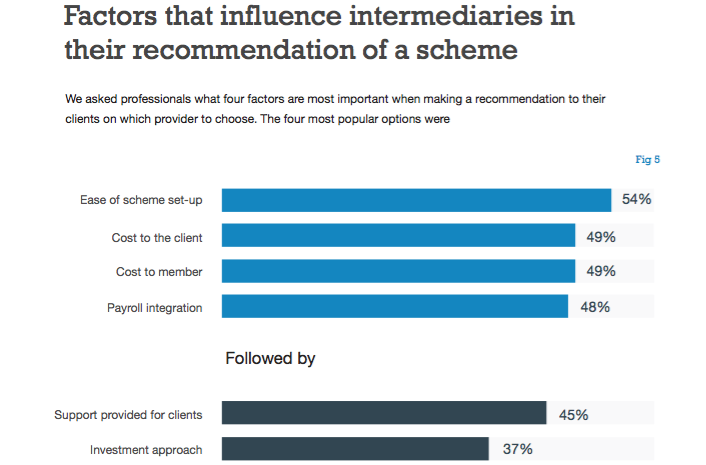

The research, across 111 financial advisers, EBCs and other intermediaries, and 25 employers, found ease of scheme set-up was important for 54 per cent of intermediaries, while just 37 per cent cited the scheme’s investment approach as an important factor.

Cost to employer and employee and payroll integration were also considered top factor for intermediaries making auto-enrolment provider recommendations, highlighting the extent to which selections are being made on the basis of ‘here and now’ issues rather than long-term ones.

The People’s Pension achieved the highest user experience rating across intermediaries, scoring 7.3m compared to Legal & General on 6, with Nest and Now: Pensions lagging. User ratings reflect email support, ease of online set-up, employer and adviser call centres, online help and support materials.

The small sample of employers surveyed suggests employers are twice as interested in the cost to them in setting up an auto-enrolment scheme than they are in the costs their employees will pay. Just 25 per cent of employers polled said the cost to members was an important factor in their choice of provider, compared to 48 per cent who cited cost to the employer. An equal number said ease of scheme set-up was a priority, with 42 per cent citing payroll integration and 38 per cent prioritising member communications.

Pension Playpen founder Henry Tapper says: “Clearly employer and intermediary support are critical to intermediaries and trump factors likely to influence member outcomes (such as the default investment strategy, at retirement options and the capacity of a provider to sustain current pricing.)

“Intermediaries are choosing on the “here and now” and factors that influence the employer’s experience.

“Intermediaries show a strong interest in payroll integration. It will be interesting to see if this becomes even stronger in 2016 as the numbers of employers rocket and the strain of auto-enrolment is picked up by accountants and their payroll bureau.”