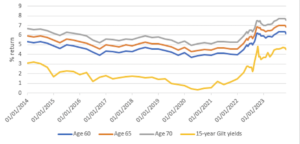

Annuity rates have risen by 54 per cent in just two years as a result of rising interest rates and increased returns on gilts.

Figures published by Canada Life some that that at the start of 2022 a 65-year old £100,000 pension pot could have bought an annuity income of £4,540 a year. At today’s annuity rates a 65-year old with £100,000 pension can secure an income of around £7,000 for life. This rate assumes no health or lifestyle conditions to declare

Over the course of a 20-year retirement this would mean an additional £49,200 in income – with the difference being even higher for those that live into their 90s.

This increase comes on the back of significant increases in annuity rates in 2022.

Canada Life retirement income director Nick Flynn says: “While many had effectively written off annuities due to the perceived poor value being generated, they are now very much back in vogue.”

He adds that given the increasing numbers of pension savers are buying annuities, particularly given the current economic uncertainty – with many opting for a “mix and match” approach when it comes to their retirement income by combining annuity and drawdown strategies.

“In a perfect storm, annuities are the only safe ship in town which can generate 100% income security. Combining annuities with drawdown, can often generate a better retirement income. Balancing the need for security and flexibility, and de-risking drawdown investments over time, by banking the annuity rate, can be a smart move.”

He adds that the he immediate future for the annuity market is looking very positive, with product innovation, including fixed-term products, and longer guarantees on capital protection — ensuring some money can be passed to heirs should the annuity buyer die shortly after purchase.