Aviva has extended the mental health cover available on a range of its corporate PMI products to support those with gambling and gaming addictions.

This is available on its Optimum PMI scheme, for companies with 250-plus employees.

Last year this product offered a new ‘mental health pathway plus’, which provided support for employees with drink and drug addictions. This has now been extended to cover any addictive condition.

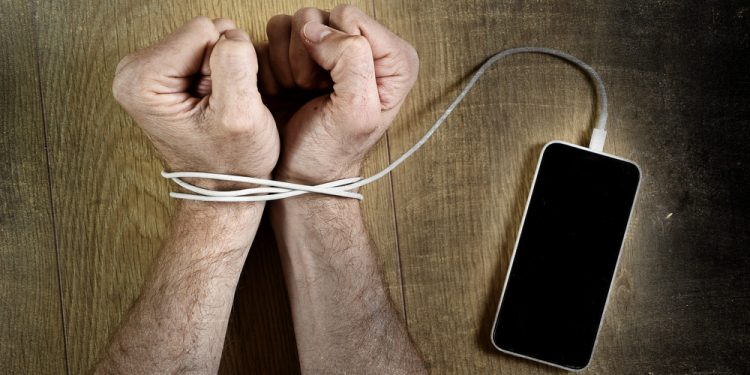

Aviva says this is a response to growing evidence that smartphone use enabling easy, round-the-clock access to online gambling, gaming and social media is leading to new addictive behaviour

Research published last year shows that addictive behaviours are costly for companies in terms of lost productivity, with research showing that alcohol abuse alone is costing UK businesses £6.4bn a year.

Aviva’s medical director Dr Doug Wright says: “Addictions can have a huge impact on an individual’s mental wellbeing, and to their home and working life.

“While there’s no doubt that digital technology offers many benefits, it’s also driving behaviours which could increase people’s health risks.”

“The internet and smartphone apps are leading to technology-driven addictions such as online gaming and sensation-seeking entertainment as well as preoccupation with social media.

“We have responded by broadening our mental health cover to ensure businesses can opt to extend their support for employees affected by these emerging addictions.”

Children aged 13 and over and covered by their parent’s policy can access mental health support services too, which comes amid rising concern about the impact of social media on the self-image of young people and easy access to mobile gaming apps.

Mental Health Pathways Plus has also removed clauses governing some chronic mental health conditions to improve assessment, monitoring and treatment for individuals with long-term mental illnesses.

The service focuses on helping to keep employees in the workplace where possible, and support when they are off work, to return sooner. It provides access to a network of 2,200 clinicians without the need for GP referral, and assessment with a mental health practitioner within 48 hours.

A range of treatment options includes online cognitive behavioural therapy, remote sessions by phone or video link, face-to-face therapies and in-patient treatment where clinically necessary.