The Government requirement for schemes to reach £25bn by 2035 is already influencing adviser selection, amid concerns that some mid-sized players may be forced to leave the market.

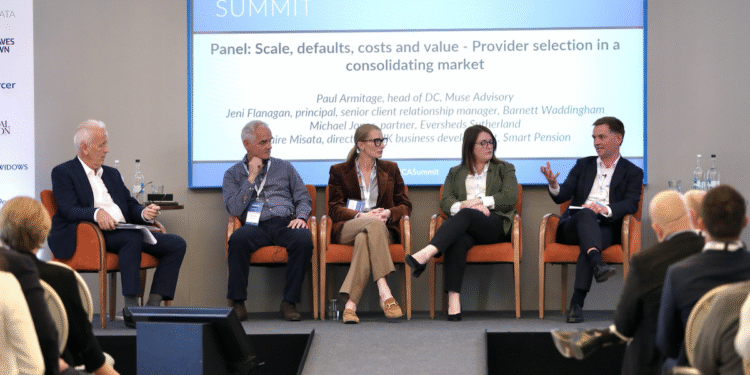

This was one of the key talking points at a panel discussion at the Corporate Adviser 2025 Summit.

Muse Advisory head of DC Paul Armitage said he was conscious that he did not want this to become a “self-fulfilling prophecy” with smaller players omitted from recommendation lists and then given little chance to achieve the required scale.

He added that he was conscious of this requirement though, with many clients making it clear that they were looking for a longer-term pension provider.

Armitage said he had already contacted providers who were currently at less than £10bn asking for a business plan to achieve the relevant scale. “Some have clearly already got this and have shared it with us, some have gone away and created one, while others have said to us they will get there, but have not been able to validate how or share any plan.”

Barnett Waddingham principal and senior client relationship manager Jeni Flanagan said the advisory firm did not want to rule out any providers at this stage, but she said the company was looking at providers’ roadmaps to achieve scale. “It is clearly a very challenging time. But we want to ensure providers are given a chance to get to this position by 2035.”

Eversheds Sutherland partner Michael Jones pointed out that legally there was little providers could do to challenge this scale requirement as it was primary legislation. However he raised the possibility that providers who remained under the £10bn limit may be able to apply to the regulator for an exemption for a protected period. There is also the ‘new entrant pathway’ – designed to allow more innovative players into this market who do not necessarily have scale, but this is only available to new entrants after 2030.

The one provider on the panel, Smart Pension, which is currently below the £10bn level said they were lobbying the regulatory and government to green light its roadmap plans ahead of 2035. Smart Pension’s director of UK business development Clare Misata said the company was currently had £7.5bn AUM, and would be at £8bn by the end of the year due to acquisitions, with concrete plans to reach £10bn by next year.

She said: “We don’t want to wait until 2030 for the regulator to approve roadmap plans, as this would create a more disorderly market.”

The panel also discussed current default strategies, particularly in relation to private markets, with some providers promoting a multi default approach and others looking to incorporate this asset class within their main default.

Flanagan said: “There are pros and cons to both. With the dual approach there is choice for the client. There also might be a question of parity when it comes to looking at performance under the value for money framework.”

She also raised the question of how explicit the charging might be on a single default, particularly if there is an element of performance fees.

Jones pointed out that under the Mansion House commitments, private market allocations apply to mainscale DC defaults and only the largest providers would realistically be able to run more than one default. He said that it seemed inevitable that over time many providers would combine default strategies.

There was also debate about the proposed value for money framework. Armitage said that under current proposals it was likely that there would be a “sea of green” when providers start to publish their ‘traffic light’ assessment of whether they are delivering value to their membership. This he said was sub-optimal. However the panel acknowledged that further consultation was expected on this issue.

Finally, those on the panel discussed the sheer weight of policy initiatives currently affecting the industry — from value for money, guided retirement, dashboards, targeted support, Mansion House commitments and the legal requirement to deliver scale. Panellists were asked whether whether the government and regulators are delivering a sensible sequence of reforms.

Flanagan said she thought the sequencing was broadly sensible, but there was “too much at once” for the industry. She said this can lead to a “lack of focus” on some cases.

However Jones said there was a missed opportunity in this package of reforms. “By 2027 schemes will have to provide a guided retirement option that will include income solutions. However retirement only CDC will not be available at this time.

“This seems like a missed opportunity and it could be more timely. Schemes may look at CDC at a later date but many may be reluctant to revisit this is they already have other provision in place.