The Pensions Regulator has warned that schemes must build the governance, skills and budgets to assess the full range of asset classes, including private markets, or face consolidation.

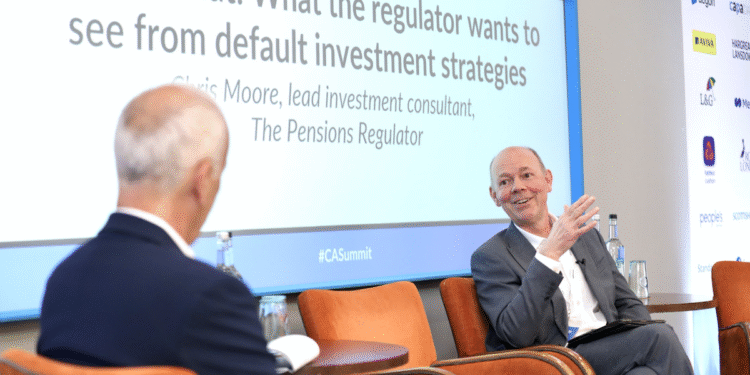

Speaking at the Corporate Adviser Summit 2025, Chris Moore, lead investment consultant at TPR, said the regulator would not dictate where schemes invest. But he stressed that capability is essential if members are to benefit from the opportunities opening up through regulatory change and industry initiatives.

Moore said the new Pensions Bill and value-for-money framework are driving private markets to become a mainstream reality.

He said: “We’re seeing private markets being adopted now, or as the default within default across the market, which I think is great, because anything which could add value for members at the end of the day is what we want to see.

“It’s not our place to mandate anybody to invest in particular. We’re not going to tell people you should be investing here. What we want is that schemes and providers have the capability to be able to assess every kind of investment that can add value for their members.”

Moore highlighted how the market has grown over the past five years, from the 2020 Productivity Pilot to today’s 25 authorised sub-funds across nine umbrella schemes. But he emphasised that building capability takes time. He said: “It is a long-term thing. It takes time to build capacity, to build product that people can access in this space.”

He acknowledged how industry efforts like the Mansion House Compact and Accord have strengthened the trend, with 17 schemes pledging to invest 10 per cent in private markets, 5 per cent in the UK.

Moore added: “I don’t believe those schemes would have signed up if they didn’t believe there was the possibility to do it well, and that it was the right thing to do. There is a general trend and I think there’s acceptance that this is the way to go.”

He added: “I’d expect you’ll see the level of private market investments increasing.”

Moore said TPR is focused on both innovation and performance, highlighting the launch of its Innovation Support Service and early hackathons to surface new ideas across accumulation and decumulation. He noted growing interest in annuities and a shift toward single default strategies that combine growth and de-risking.

He said: “Capability, scale and innovation will shape defaults going forward.”