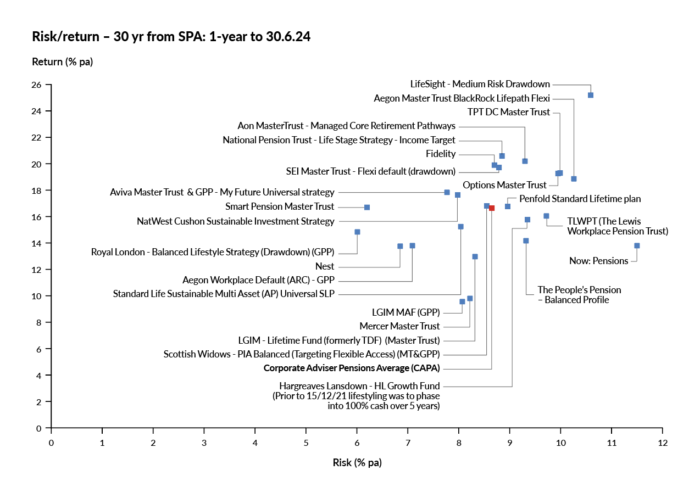

All providers saw positive returns in the year to June 2024 as the market set aside concerns over the global economy escaping recession – while the UK experienced a technical recession – and as inflation continued to fall.

LifeSight’s Medium Risk Drawdown strategy returned 25.2 per cent before charges, contributing to a 5-year annualised return of 11.5 per cent for savers 30 years from SPA.

NPT’s 20.6 per cent one-year return kept it in the top spot over five years with an annualised 11.94 per cent return, while Aon’s 20.2 per cent annual return boosted its five year figure to 11.8 per cent.

The CAPA average for younger savers stood at 16.61 per cent over one year and 7.88 per cent over five years.

At the other end of the table, Legal & General’s Multi Asset Fund returned 9.56 per cent in the year to Q2, 2024. However, the provider’s go-forward default, the Lifetime Fund, formerly the TDF, returned 13 per cent over the period.

Pre-retirement phase

In the crucial cohort for savers five years from state pension age, when many schemes are starting to derisk members’ pots but when asset values are at their highest, the CAPA average stood at 12.55 per cent over one year and 4.98 per cent over five years. The SEI Master Trust and NPT topped the 5-year table for investors five years from state pension age, with an annualised return of 8.45 per cent and 7.68 per cent respectively, before charges are deducted. Fidelity’s FutureWise default had the lowest return at 2.4 per cent annualised over five years. It was followed by Legal & General’s Multi Asset Fund on 2.85 per cent and Now: Pensions on 3.4 per cent over five years. Figures shown here and for at-retirement are the annualised return of the strategy adopted for members at that age, not the five-year returns experienced by individual savers reaching that age.

At-retirement returns

The at-retirement strategies of NPT, Aon and Aegon’s ARC GPP default achieve the highest

returns in the year to June 2024, before charges, with returns of 14.2 per cent, 13.7 per cent and 12.7 per cent respectively. This is against five-year annualised returns of 6.9 per cent, 5.7 per cent and 5.9 per cent for the at-retirement strategy. The CAPA average return over one year stood at 10.3 per cent and over five years at 3.51 per cent.

Hargreaves Lansdown’s five-year figure was the lowest, standing at 1.02 per cent, although it has recently switched its landing point away from a cash target, and achieved an 11.5 per cent return over 5 years.