Carillion, the stricken construction company, has been attacked for paying an increasing dividend for 16 years while presiding over a pension deficit in excess of half a billion pounds.

More than 14,000 non-retired Carillion scheme members now face a reduction in benefits if, as expected, the collapsed construction company’s scheme goes into the Pension Protection Fund (PPF).

Carillion has filed for compulsory liquidation after it failed to reach agreement with creditors over outstanding debts.

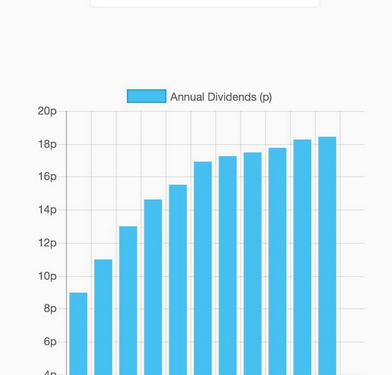

Royal London director of policy Steve Web Webb has questioned the rising dividend of the company. On Twitter he said: “Annual report says dividend ‘has increased in each of 16 years since formation of company’; Is this really acceptable alongside a pension fund deficit over half a billion pounds?”

Last June the Pensions Regulator warned that the ratio of deficit repair contributions (DRCs) to dividend payments by sponsoring employers had declined.

Pension experts say absorbing the scheme, which has a £580m deficit scheme, will not sink the PPF, which currently has a surplus of around £6bn. Carillion’s dividend increased per share increased from 9p in 2006 to over 18p in 2016.

According to the 2016 Carillion annual report, the defined benefit pension scheme has 28,561 members, of whom 12,410 are pensioners.

Webb says: “Carillion workers will understandably be devastated by the announcement of the liquidation of their firm. But they, and retired Carillion workers, can be assured that the pensions ‘lifeboat’, the Pensions Protection Fund (PPF), will help to protect their pensions. Although there is a big shortfall across the Carillion pension schemes, the PPF is financially strong and will be able to pay out pensions in line with its normal rules. The deficit in the Carillion schemes will not sink the pensions lifeboat’.

Hargreaves Lansdown head of policy Tom McPhail says: “The reported Carillion scheme deficit of £580 million looks big, but thanks to prudent management in recent years the Pension Protection Fund currently has a surplus of over £6 billion so they can absorb this hit if they have to. Scheme members can expect the administrators and the PPF to work together to ensure there is continuity of payments. It is highly likely the scheme will now be taken on by the PPF.

“Whilst the PPF provides valuable security, members who have not yet reached retirement should be prepared for a cut to their pension pay outs. This will involve an immediate cut of 10%, plus the possible loss of some inflation proofing; higher earners may be affected by the PPF cap on payouts which currently stands at £34,655.05. An upward adjustment to the cap applies to those members with 20 or more years’ service. Members who have already reached normal retirement age should continue to enjoy 100% of their current pension payments.

“The PPF was established for precisely this kind of situation. It is a well-run scheme with a healthy surplus and a well-established system of funding based on levies on other pension schemes.

“Assuming the PPF does take on the Carillion scheme, the assessment process could take months or even years. In the meantime, the Carillion scheme administrators, the liquidators and the PPF can be expected to work together to ensure continuity of payouts for scheme members.”

The Pensions Regulator executive director Nicola Parish says: “The situation regarding Carillion is concerning for all those affected. We continue to work closely with all relevant parties in what are very challenging circumstances, including the pension scheme trustees, the official receiver and the government, to help achieve the best possible outcome for members of the pension schemes and those impacted by the situation.

“It is too early to comment on possible outcomes for the various pension schemes connected to Carillion. In the meantime, I would like to assure scheme members that the government set up the PPF to support members of workplace pensions in precisely these circumstances.”