The Work and Pensions select committee is launching a new inquiry into defined ambition pension schemes, which were legislated for but not fully implemented in 2015.

The inquiry will consider whether collective DC arrangements can give better outcomes than traditional DC plans, how they might be governed and whether seriously underfunded DB schemes could change their pension contract to CDC, along the lines of Dutch plans.

They are commonplace in the Netherlands, Canada and Denmark.

The committee argues that CDC schemes take the big central decision of pension freedoms out of retirement planning, and reduce much of the risk. They would also be more suitable for infrastructure investments than traditional DC schemes, argues the committee.

The committee says its ongoing inquiry into pension freedoms has highlighted the general level of mistrust and disengagement with pension plans, at a time when policymakers are keenly looking for ways to get people to plan and save much more for their retirement.

Advocates of CDC schemes argue that they provide greater assurance of retirement income and more efficient pooling of costs and risks among members than traditional DC, but do not impose the burden of underwriting an onerous pension promise on employers, says the committee. It cites studies by the RSA and Aon Hewitt estimating that CDC could have delivered 33 per cent better pension outcomes than traditional DC over the past half-century.

Detractors argue that CDC may further fragment the pension landscape, suffer from lack of demand, and run counter to the trend towards greater individual freedom and choice in pensions.

The Pension Schemes Act 2015 created by the 2010-15 Coalition Government defined “shared risk/defined ambition” or CDC as a distinct pension category. However, regulations under the Act to bring them into effect have not yet been introduced. In October 2015, the Government announced the plans would be shelved indefinitely so as not to distract from other major reforms such as auto-enrolment and pension freedoms.

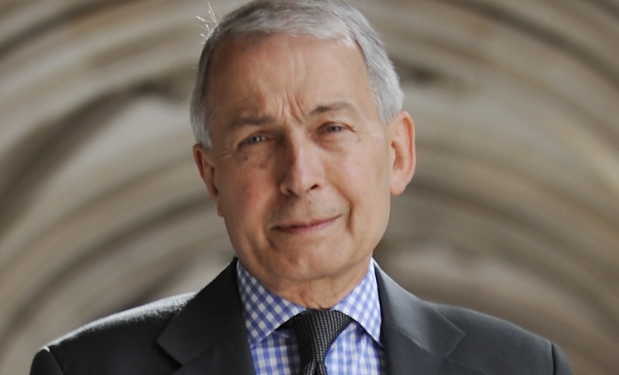

Committee chair Rt Hon Frank Field MP says: “What the select committee is aiming for is to retain some of the best features of company schemes in a different age when employers are no longer willing or able to sustain the burden of final salary promises to employees, who could instead club together and pool the risk themselves.”