Investors who chose their own funds have beaten the performance of the default funds they have opted out of by 4.89 per cent a year over the past five years, research from Hargreaves Lansdown shows.

The figures, which cover a period of steadily rising equity markets and which cover 12,000 members, show that self-select investors’ tendency to opt for more aggressive strategies has yielded higher returns than default funds which typically have around 65 per cent exposure to equities. It compared the average performance of nine major defaults, including its own, against the top 10 funds selected by members of GPPs. The average annualised return of the most popular selected funds was 14.26 per cent in the five years to December 2017, compared to 9.38 per cent for the average default. The research does not cover the potential impact that negative markets would have had on the portfolios.

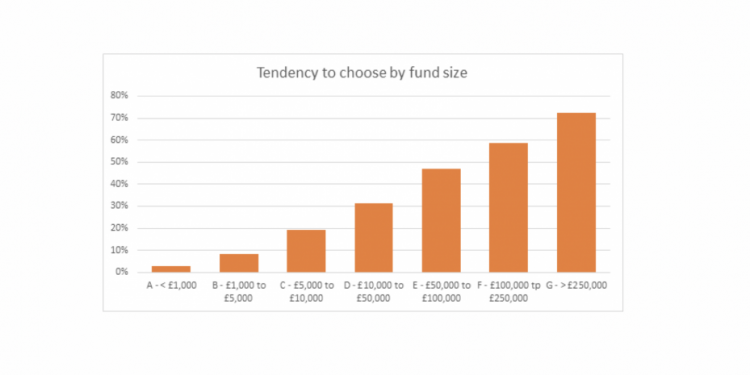

Hargreaves’ research shows that confidence to invest grows as savers’ pension pot increases and the longer they are a member of a plan. Its figures show that once a pension pot is worth more than £100,000, more than 50 per cent of investors will exercise an active choice over their investments. Above £250,000, nearly three quarters are actively engaged. Hargreaves found almost 4 out of 10 people who have been pension members for 5 to 10 years will exercise an active choice over their investments.

The research runs contrary to some pensions and investment experts who argue that many investors who make choices without advice can end up chasing performance, buying at the top of the market and selling at the bottom.

Hargreaves Lansdown senior pension analyst Nathan Long says: “Conventional wisdom may be that choosers are losers, but that work may not account for getting access to leading research. Our own experience is that people can make informed decisions, but we are tipping the balance in their favour by sharing with members the findings from the thousands of hours of investment analysis that we conduct each year. We are extremely selective about which funds make the cut onto our Wealth 150 and this seems to be making all the difference. It is also fair to say that the choosers are generally taking a higher equity exposure than default funds, but for those comfortable with being more adventurous and with a long time until retirement this is not unreasonable.

“Default funds are a necessary element of auto-enrolment pensions but by their nature they are designed to be a conservative one-size-fits-all solution. For most people, better investment options are available. If the choice is between increasing the amount you pay into your pension every month, having to work a few more years, or making your pot grow faster by choosing better investments, most people would probably go for the latter option. Getting to grips with investing your pension can seem daunting, but many pension members are improving their retirement prospects by doing just that.

“Improving your returns by just 1 per cent every year could save the average person £64,000 over a lifetime of pension saving. Getting started is easier than you think. Most investment brokers have their list of the top investment funds available and provide tips on how to choose something that suits you. If you need more help paying for financial advice can be worthwhile.

“This data suggests consolidating pension plans, making managing the investments easier can boost engagement levels. It also supports calls from within the industry for employees to be allowed to choose which service they want their auto-enrolment contributions to be paid into, with a default provider as we have currently for those that do not want to choose. Not only does this cut down on the number of small pension pots, it also allows members to become more and more confident using their pension service.”