It has been raining regulation for some time now and with that comes consequences – both intended and not so much. The Financial Advice Market Review is testament to a gaping unintended consequence of the RDR and we have plenty more waiting to clobber unassuming and unprepared businesses as we move into the new “professional” era.

From Mifid II to the rise of the robots, we see a challenging terrain ahead for advice firms. However, if strategic planning is applied to five key areas, risks can be addressed, managed and turned into opportunities.

1: Business model

Whether restricted or independent a clear and understandable explanation of the business model is essential. Mifid II will challenge and redefine “information for clients” so disclosure of status, charges and costs needs to be crystal clear.

The nature of independence will be an interesting issue, with the directive proposing a “suitable range” of products will suffice, not the current (entirely improbable) whole of market approach. This is good news, given the difficulties the regulator has had in nailing down a true definition of independent advice. Those businesses that operate an agile model incorporating new technologies will thrive.

2: Client and stakeholder engagement

A paperless office will be one that is as “future proof” as can be. With the move away from wet signatures, client portals and digital engagement is the key to creating value. From a compliance perspective, those firms that operate telephone and meeting recording will provide high quality engagement and accountability to clients and the regulator.

3: Client service propositions

Our research into consumers’ needs and objectives finds those firms that apply “enabler tools” in a meaningful way will showcase high value in their propositions.

By segmenting clients not just by assets but through behaviours, sensitivities and propensities, then applying social media and automated marketing techniques, clients’ knowledge and understanding for the proposition will increase. This will answer the crucial question: what is in it for me?

Where the robots are concerned, our research highlights clients still value the human touch.

4: Operations and service supports

Any one interested in team sports will know it is those teams that have a system everyone understands and knows that will thrive and win. Just look at the All Blacks during last year’s Rugby World Cup: a highly drilled system with discipline and flair at its core means the team can operate at a different level.

And so it is for business. Firms that can gain an effective back- to front-office system incorporating streamlined technology to operate the client and business management tasks, ensure effective data feeds and efficient task management will succeed and build solid foundations.

A business and product governance strategy that offers management information that will identify good and poor outcomes, manage conflicts of interests and report accurately to the board will ensure happy regulators, stakeholders and clients.

5: Human resource development

According to Richard Branson, businesses that ensure engaged employees can boast happy clients. By focusing on legacy and talent management, firms can move to a model that empowers staff through remuneration and performance management based on client loyalty and advocacy, not just products sold.

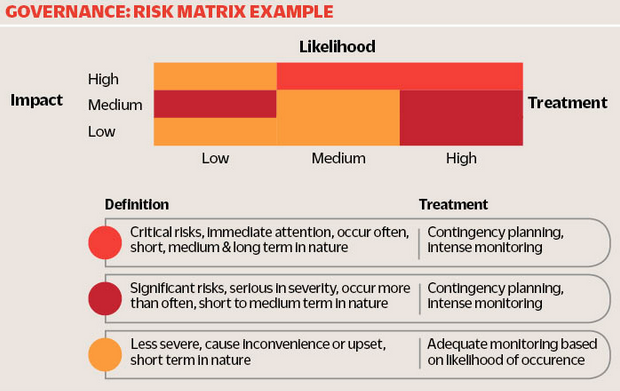

These models are starting to appear more and more as the industry evolves, yet we would argue the pace of change is beginning to overtake some. A good way to assess where a firm stands on these five key points is by applying the risk matrix in the diagram (below).

Chris Davies is managing director at Engage Insight