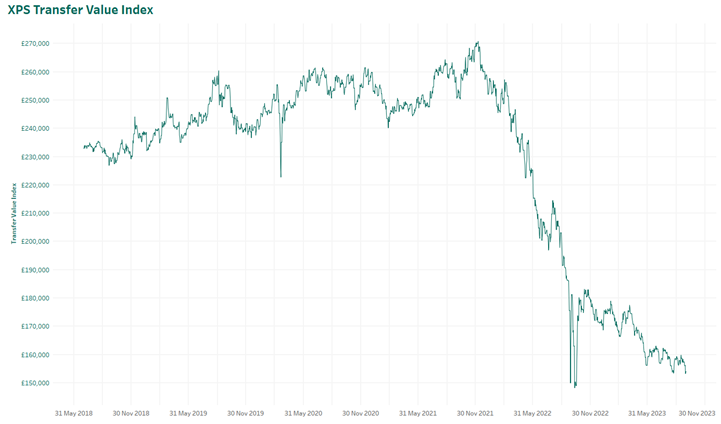

Defined benefit (DB) transfer values fell by 3 per cent in September, driving a fall of 15 per cent over 12 months, and leaving transfer values a third lower than they were at the end of June 2018, according to figures from XPS.

XPS’ Transfer Value Index shows the estimated Cash Transfer Value of a 64-year-old member with a pension of £10,000 a year with typical inflation increases fell to £154,000.

XPS’s transfer activity index also fell in September 2023, with just 21 members in every 1,000 transferring their benefits to alternative arrangements, down from a high point of 87 in December 2022, but slightly ahead of a low of 19 in July 2023.

XPS says 92 per cent of cases reviewed by its Scam Protection Service in September raised at least one scam warning flag. This represents an increase from 86 per cent from the previous month and has seen the Index return to a similar level to that observed since the introduction of the 2021 transfer regulations. This follows the spike in volumes of members transferring to purchase an annuity, which has a lower risk of scam activity, falling back to the levels seen in previous months.

Helen Cavanagh, client lead at XPS Pensions Group’s Member Engagement Hub said: “With the transfer value index falling to a record month-end value, we’ve also seen the number of members electing to transfer remaining low. This continues the trend of falling transfer activity, with two months of the last quarter containing the lowest transfer volumes we have witnessed since starting the Index. It may be that lower transfers values are resulting in fewer members concluding that transferring is the best option for them.”