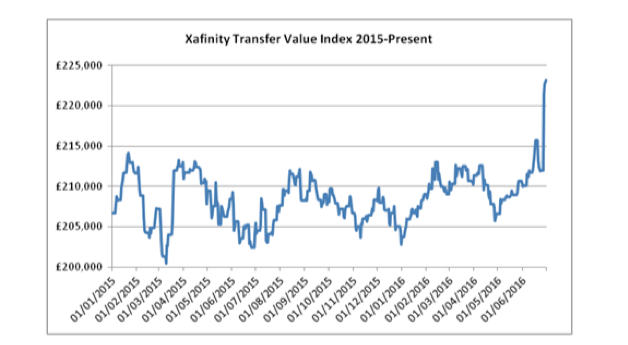

Transfer values from defined benefit schemes have soared following the UK’s vote to leave the European Union.

Transfer values are now 4 per cent higher than the highest reading ever seen on Xafinity Transfer Value Index, back in 2015. The index shows that as at 30 June 2016 a DB scheme member aged 64 who is currently entitled to an index-linked pension of £10,000 each year starting at age 65 would now receive £223,000.

The highest reading of the Index in the whole of 2015 was £214,000.

The increase in transfer values has been largely driven by significant reductions in Gilt yields since the results of the vote were announced. Deficits across most schemes have also increased, however.

Xafinity head of proposition development Paul Darlow says: “Whilst these reductions in Gilt yields are good news for members looking to take a transfer value of their defined benefits, it is not good news for pension schemes themselves. Most pension schemes will have seen their deficits increase significantly. Pension schemes should consider whether paying out significant amounts of transfer values when deficits are high, and asset values are perhaps depressed, could have a detrimental impact on the financial position of the scheme.”