Workplace pensions enjoyed a massive rebound in the year to 31.3.21, with younger savers in the Aegon Master Trust’s Flexipath and the Ensign defaults up 45.3 per cent, while the Corporate Adviser Pensions Average (CAPA) return of 27 leading defaults was 32 per cent. FOR INTERACTIVE PERFORMANCE TABLES, CLICK HERE. FOR RISK/RETURN SCATTERS, CLICK HERE.

The figures, which cover the 12 months from a few days after the low point of last year’s Covid crash, show the benefit reaped by investors who rode out the market turmoil.

All workplace pension scheme default funds, used by the great majority of savers, have more than wiped out the losses incurred in the first three months of 2020, when stockmarkets tumbled in response to the first coronavirus lockdowns.

Back then, while the FTSE100 fell 34 per cent between New Year’s Day 2020 and the bottom of the market on 24th March 2020, typical workplace default funds suffered big, but less serious falls, because of their diversification into a wider range of assets.

Funds designed for younger savers saw falls of around 20 per cent, with Nest down 19.4 per cent, Scottish Widows down 17.1 per cent and Aviva’s My Future default down 18.7 per cent from the beginning of the year to the bottom of the market.

LifeSight and SEI also saw their 12 month returns top the 40 per cent mark.

FOR INTERACTIVE RISK/RETURN TABLES – CLICK HERE

Gulf in five-year returns

LifeSight’s strong rebound pushed its five-year annualised return to the top of the table, delivering 13.5 per cent a year, a cumulative return of 88.4 per cent, before charges are deducted, or a return of 84.2 per cent assuming a 0.5 per cent charge. The CAPA data set shows 17 default funds had annualised returns, excluding charges, in excess of 10 per cent a year over five years. The CAPA average for younger savers return stood at 10.27 per cent annualised over five years, a 63 per cent return before charges, or 59.4 per cent return factoring in an assumed annual management charge of 0.5 per cent.

Schemes with a higher focus on volatility controls not surprisingly saw much lower rebounds. Now: Pensions’ younger saver strategy returned 17.4 per cent over the 12 months to 31.3.21, with Legal & General’s Multi-Asset Fund returning 21.2 per cent.

Now’s 5-year return for younger savers was the lowest in the CAPA universe, standing at 6.15 per cent annualised, which at 34.8 per cent cumulative is less than half that delivered by LifeSight.

Standard Life’s five-year return for younger savers was 6.44 per cent, a 36.6 per cent return.

At-retirement returns

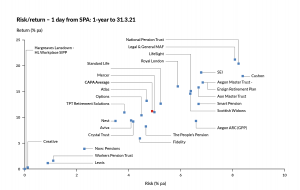

Legal & General’s Multi Asset Fund delivered the biggest return for savers one day from retirement, rising 21.2 per cent in the year to Q1, 2021.

At the other end of the scale, Hargreaves Lansdown’s Workplace SIPP default returned zero per cent before charges, although members are encouraged to invest outside the default in that fund. Creative Pension Trust delivered 0.28 per cent, while Lewis Workplace Trust and Workers Pension Trust delivered 1.14 and 1.6 per cent respectively.

The statistics highlight the massive disparity in investment derisking glidepaths adopted by workplace default funds, underlying the importance of increasing engagement with members not just at the time of retirement, but in the years prior to retirement.

The statistics highlight the massive disparity in investment derisking glidepaths adopted by workplace default funds, underlying the importance of increasing engagement with members not just at the time of retirement, but in the years prior to retirement.

National Pension Trust’s at-retirement strategy has seen the strongest returns over the last five years, at 10.64 per cent annualised, before charges are deducted, with L&G’s MAF in second place at 8.4 per cent annualised.

About the CAPA performance data

The Corporate Adviser Pensions Average (CAPA) gives a peer ranking view of the outcomes delivered by the different strategies operating in the sector.

The CAPA average is the average (mean) return delivered by 27 default funds, covering the investment strategies applied to the pots of over 12m active and 10m deferred UK pension savers, across three age cohorts.

CAPA data analyses investors in the growth phase (30 years to SPA), pre-retirement phase (5 years to SPA) and at-retirement (one day to SPA).

Returns are shown before charges are deducted to enable genuine comparison of the performance attributes of different providers, and because most providers operate variable charging structures.

For more detailed data, including quarterly performance updates on all providers in this report, go to www.capa-data.com.

The CAPA data set is the only independent, publicly-available source of data on the default fund sector that takes its inputs directly from all the individual providers, and is not based on assumptions, calculations and performance data generated by third parties.

Performance data is, by its very nature, backward-looking, and benefits from hindsight. Had markets behaved differently, different providers would have topped the tables. CAPA performance figures should be read in conjunction with the risk data contained in this chapter. For more default fund performance data go to www.capa-data.com