The organisation says that there is no need to go beyond scrapping qualifying and band earnings and bringing auto-enrolment down to age 18, as a survey of 44,000 workplace pension members it has conducted shows over 50 per cent voluntarily choosing to increase their contributions. The research covers schemes overseen or run by Hargreaves Lansdown, and therefore is not reflective of the entire auto-enrolment population in terms of pay and being online at work.

The research shows men and women are virtually equally inclined to contribute more, with 51 per cent of men are contributing more, compared to 49 per cent of women. It shows people are more than twice as likely to pay in more if their pension pot exceeds £10,000 as those with a pension of less than £5,000.

Not surprisingly, the research confirms there is a tendency to contribute more increases with age: 61 per cent of those aged over 50 pay more, compared to 36 per cent of under 30s.

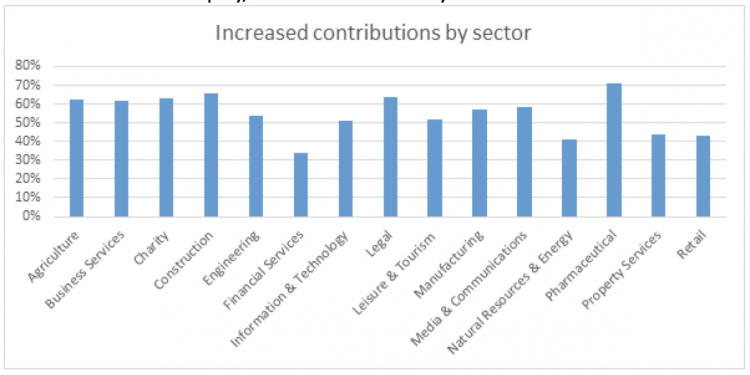

Workers in the finance sector are the least likely to contribute more, although this is in part because a higher proportion of them are already hitting either the lifetime or annual allowance. Only a quarter of those earning over £100,000 increase the amount they contribute, due to a complex web of limits and allowances, says the report.

Hargreaves Lansdown senior analyst Nathan Long says:“Minimum pension contributions are not enough for most to retire in comfort, but the Government needn’t be pressured into forcing these levels up. Getting people voluntarily saving more for retirement is already possible and will only get easier as technology improves and pension pots get larger.

“Forward looking employers are already providing workplace financial education and incentivising staff to pay more by matching what they will pay in themselves. Rather than force up minimum contributions the Government and employers should focus on what engages staff to voluntarily pay in more.

“Multiple studies have shown women to be less confident with their finances, but this data shows they have the same appetite to save more as their male colleagues. The Treasury’s continued policy of salami slicing incentives for higher earners to save is clearly working, as there is a steep drop off in additional contributions amongst those earning over £100,000.

“We analyse 7 different ways people can interact with their workplace pension. Of these, upping contributions is the weakest indicator to further engagement. 21 per cent who up their contributions do not go on to further engage with their pension.

“Getting people interested in their investing on the other hand brings far deeper levels of engagement. 70 per cent of those who have chosen their own investments have also increased their contributions. This compares to only 45 per cent who remain in the default fund.

“People value human interaction. 42 per cent of people increase their contributions where they have not met with someone personally, however this jumps to 66 per cent of those who have taken up the offer of a face to face meeting.”