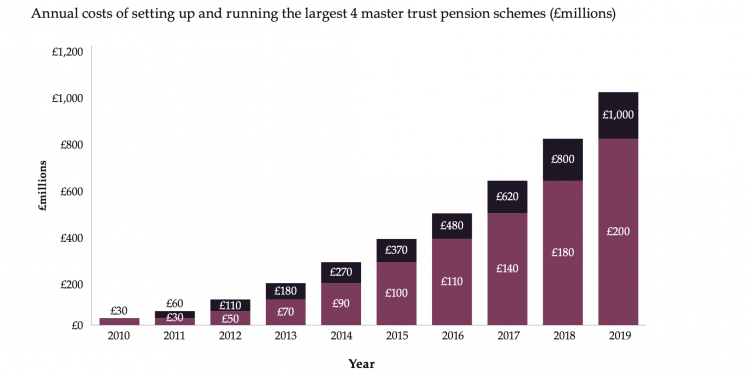

The cost of running the four biggest master trusts in the UK is £200m a year and costs across the master trust sector will rise to around £1bn a year by 2035, according to research from the Pensions Policy Institute (PPI).

The research, which analyses the costs of Nest, The People’s Pension, Now: Pensions and Legal & General’s WorkSave Master Trust, predicts that master trust providers will not achieve break-even point until around 2025, after which profits may accelerate, subject to competition between providers through reducing charges.

But the sector faces unknown headwinds, with data cleansing for the dashboard, the growing number of small pots and the unpredictable impact of Covid-19 all potentially impacting profitability.

The PPI says £1bn has been spent on running the four big auto-enrolment schemes over the last decade. Much of the growth in costs is due to the cost of investment management, which is linked to the size of funds. The PPI research predicts that annual costs will rise to around £1bn a year by 2035. While investmnent management costs only represent a small proportion of this cost at present, growing fund sizes mean this will rise to almost half the overall cost 15 years from now.

The greatest challenge to the financial sustainability of master trusts is the need to cover initial start-up and running costs until levels of membership and assets have grown sufficiently, says the report, which was commissioned by Now: Pensions.

The report argues consolidation of multiple pots belonging to a single member could help to make master trust running costs more efficient.