New figures released today by the Office for National Statistics provide more evidence that the DWP will have to ‘rethink’ its plans to keep raising the state pension age at such a rapid pace, according to LCP partner Steve Webb.

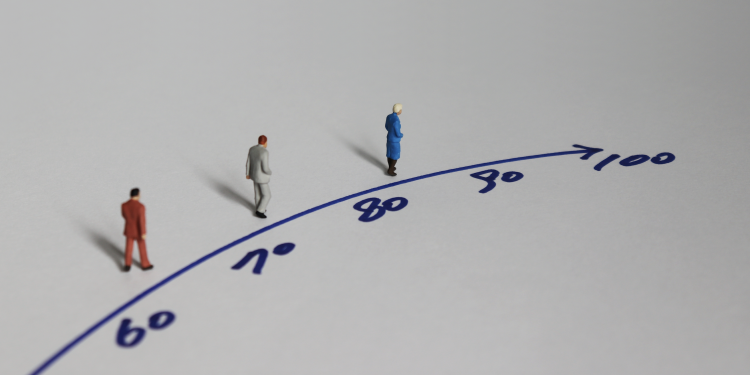

According to current projections, the state pension age will rise from 66 to 67 between 2026 and 2028. Existing legislation predicts an additional increase to 68 between 2044 and 2046. But a 2017 review of state pension ages predicted reaching 68 in 2039 – seven years sooner.

Following the publication of projections based on 2018, LCP determined that the transition to 67 and 68 would need to be postponed for several decades.

The ONS released new estimates based on 2020 population data today. These projections show a further decline in life expectancy at current state pension age for both men and women. When compared to the projections on which the previous state pension age review was based, the new projections indicate that life expectancy for men and women currently at pension age is now more than two years lower than previously thought. The majority of this deterioration occurred prior to the pandemic, and the full extent to which Covid-19 will impact life expectancy is yet to be determined.

Webb says: “The last review of state pension ages was based on data which is now more than six years out-of-date. Since then, life expectancy at pension age for both men and women has dropped by more than two years. Such a dramatic shift in such a short space of time calls for a fundamental rethink of the government’s plans for increases in state pension age. With the move to 67 due to start in only four years, DWP needs to speed up its current review, as the case for rapid increases is simply not justified by the evidence”.