Switching from full to part-time work has an obvious impact on members’ earnings. But are they aware of the longer-term impact on their pensions? Here’s how your clients can support them in saving for their future.

Many people make the switch from full to part-time work, either of out of choice or necessity. There are many reasons why people may go part-time, including childcare, caring responsibilities, and personal health, as well as prioritising a manageable work-life balance.

Switching to part-time work has an obvious and immediate impact on earnings, but perhaps lesser known is the impact it could have on pensions.

Part-time workers could see a smaller pension pot

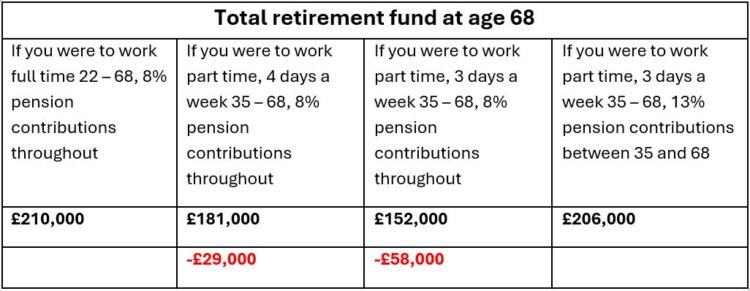

New analysis from Standard Life reveals that someone that began working full-time with a salary of £25,000 per year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from age 22, could amass a total retirement fund of £210,000 by the age of 68* in real terms, accounting for 2% inflation.

However, if they started working part-time for 3 days a week from the age of 35, they could build up a pot of £152,000 by the age of 68** (again accounting for inflation) – a whole £58,000 less than if they remained working full-time. That’s because saving at the same level, but with a lower salary to contribute from, results in a smaller amount going into their pension pot.

But raising personal contributions could make up the shortfall

If the same person was able to increase their contributions to 13% when working part time (10% employee, 3% employer), they could build a pot of £206,000 in today’s prices – almost the same level as a full-time worker paying minimum contributions.

Whilst it won’t always be possible for all part-time workers, increasing pension contributions when going part-time can go a long way to making up the shortfall in pension savings.

If members are going part-time, it’s a good idea to raise awareness of the impact this can have on their future finances. Here are a few ways your clients could offer support.

Help members understand how much they’ll need in retirement

It’s a good idea to help members understand how much they might need to fund their ideal retirement lifestyle. Your clients can help by signposting members to the PLSA’s Retirement Living Standards. This outlines how much they’d need each year to fund a minimum, moderate, and comfortable lifestyle in retirement. It can help them determine whether they’re on track, and make any adjustments to their finances if not.

If your clients are with Standard Life for their workplace pension scheme, members can also use our Retirement Income Tool to get an idea of how their financial future is shaping up. It incorporates data from the Retirement Living Standards, so they can easily track their retirement goals against their current and expected pension savings.

Boost awareness with tailored communications

Some part-time workers may be completely in the dark about the effects that working part-time can have on their pensions.

You clients could consider creating a communications campaign, targeted directly to part-time members, that boosts awareness of the facts and helps them make informed decisions about their finances. Your clients could include signposting to resources such as the Retirement Living Standards and MoneyHelper websites, as well as the Retirement Income Tool for Standard Life scheme members.

Support members with their day-to-day finances

Helping members to budget for their everyday money can help them build up their financial resilience for the future too. Indeed, if members have a better understanding of their short-term spending and saving, it can help them feel more confident making decisions for their long-term finances.

Your clients could point members towards resources such as MoneyHelper, which provides information and tools that can help them get to grips with their day-to-day finances.

Standard Life workplace pension scheme members can also use Money Mindset*** to help them get organised and set budgets. Using open finance technology, Money Mindset allows members to see their financial accounts in one place, giving them clearer view of where their money’s going. Plus, they’ll get access to a library of bitesize financial education content that can help them get to know their money better.

For more insights on financial wellbeing, including resources on how you can help support your employees, visit our Financial Wellbeing hub and read our articles.

*If beginning working with a salary of £25,000 per year and contributing 8% (5% employee, 3% employer) monthly contributions into a workplace pension from the age of 22 and assuming 3.5% salary growth per year, and 5% investment growth. Figures reduced to take effect of inflation, assumed to be 2%. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed.

**It is assumed from the age 35 in this example that the salary is changed on a pro rata basis for the number of days worked each week.

***Money Mindset is provided in partnership with Moneyhub Financial Technology Limited

www.standardlife.co.uk

Phoenix Life Limited, trading as Standard Life, is registered in England and Wales (1016269) at 1 Wythall Green Way, Wythall, Birmingham, B47 6WG.

Phoenix Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Phoenix Life Limited uses the Standard Life brand, name and logo, under licence from Phoenix Group Management Services Limited.

© 2025 Phoenix Group Management Services Limited. All rights reserved.

View more content from Standard Life at our dedicated content hub.