[SPONSORED CONTENT]

When it comes to funding retirement, different generations are favouring either property or pensions. We take a look at why a holistic approach to saving could be a better option – and what employers can do to support members’ financial futures.

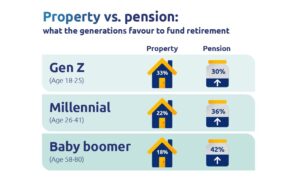

A third (33%) of Gen Zers believe that property, rather than pensions, will fund their retirement.

This is according to Standard Life’s Retirement Voice 2023 research, which reveals different attitudes between generations when it comes to funding life after work.

The coin flips for all other generations, with Millennials and Baby Boomers in particular favouring pensions over property as their main asset in retirement.

It’s understandable that younger generations would prioritise property over pensions; it’s more likely to be their biggest current financial goal.

But our insights reveal that relying on property to fund retirement may not be a realistic expectation.

Why a holistic approach could be a better way to fund retirement

According to our research, just 10% of Gen Zers currently have a mortgage, while 20% are worried about still having a mortgage to repay in retirement.

Furthermore, the Longer Lives Index, produced by think tank Phoenix Insights, estimates that over 13 million people are likely to face ongoing rental or mortgage costs in retirement.

For Gen Z in particular, it could be harder to rely solely on property than for previous generations. They’re facing higher house prices compared to their salaries, higher mortgage costs, and rising rents that could prevent many of them from saving enough to buy.

This highlights the importance of funding retirement holistically, rather than putting all your eggs into one basket. Indeed, owning property and saving into a pension aren’t mutually exclusive, and can instead sit together as part of a diverse portfolio.

Indeed, for members, pensions have a number of advantages over property. These include tax relief every time they make a contribution, as well as employer contributions and the potential to benefit from investment growth. On the downside, members need to wait until the minimum pension age to access pension savings. That said, there are benefits to this, given that pension savings need to provide the right standard of living throughout retirement.

However, don’t forget that the value of investments can go down as well as up, and members may get back less than was paid in.

How to help members engage with their retirement savings

Your clients can play a vital role in engaging with people of all generations and making sure the support and communications they receive are relevant to their needs.

Here are some suggestions to help them get started:

- Help members get a better view of their money: Open finance tools, like Standard Life’s Money Mindset, allows members see all their money in one place, including their bank accounts, savings, pensions, and mortgages. Not only can this help members to spot if there are any gaps and where to take action, it can also help support their wider financial wellbeing.

- Promote awareness of their workplace pension: Creating a targeted communication campaign is a great way for your clients to promote awareness of their workplace pension scheme, especially if some members are unsure of the benefits. If your clients are with Standard Life for their scheme, they can use our Client Analytics tool to see which groups are engaging with their pension, to help them send relevant, personalised communications to specific members.

- Support first-time buyers: For Gen Z and Millennial workers, getting on the property ladder is likely to be a high priority. Our Homebuyer Hub can support Standard Life workplace pension scheme members through the journey to buying their first home. It provides bitesize content to help simplify the homebuying process, plus personalised guidance based on members’ savings goals.

For more insights on financial wellbeing, including resources on how you can help support your employees, visit our Financial Wellbeing hub and read our articles.