The positive power of pension planning is a key takeaway from Standard Life’s Retirement Voice 2022 report, which asked almost 6,000 people from across the UK how they think and feel about retirement.

The research painted a clear picture that those who spend time planning will feel better about their finances and enjoy a better retirement.

And yet, a staggering 72% of people say they do little or no planning for retirement. For women, that figure is even higher at 79%.

Fewer women than men are planning for their financial future

The report revealed several concerning insights into women’s retirement planning:

- Fewer women are putting ‘a great deal of thinking’ into their retirement planning compared to the previous year. Just 21% say they plan a lot, down from 23% in 2021.

- Women are almost twice as likely than men to put no planning into their retirement (19% vs. 35%).

- In general, women do less planning for retirement than men – and the gap has risen from 9% in 2021 to 16% in 2022.

It’s vital that we put the spotlight on why pension planning is important and the positive impact it can have on women’s overall financial wellbeing. Here are a few examples of the benefits that planning can bring, and what your clients could do to help their female employees spend more time planning for their financial future.

Planning can help improve women’s retirement outcomes

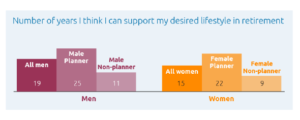

Planning plays a significant part in how long women think they can support their ideal lifestyle in retirement.

Women who plan expect they’ll be able to fund their retirement for 22 years. But for those who do no planning at all, that number drops to just 9 years.

This shows that the link between planning and good retirement outcomes is strong, with female planners predicting they’ll be able to fund an extra 13 years of retirement than non-planners.

So how can your clients help their female employees engage more with financial planning? A good place to start is to make planning as accessible as possible. Your clients could offer a variety of educational content such as videos, interactive tools, bite-sized guides, and FAQs so that their employees can choose what works best for them, based on their learning style.

At Standard Life, we have a dedicated financial education team that works with employers to create content that’s tailored to employees’ unique needs and levels of financial understanding. Your clients can also use our Ready to Go campaigns that offer a range of ready-made resources – including videos, webinars, and retirement tools – to help employees make sense of their pension plan.

Planning can raise women’s financial positivity levels

The rising cost of living appears to be having a bigger impact on women than men. Indeed, women’s financial positivity has dropped from 44% in 2021 to 33% in 2022. This is a much steeper decline than for men, whose financial positivity has slid from 54% to 50%.

The good news is that positivity levels rise to 40% for women who spend time planning, albeit it’s still below men’s. In addition, female planners worry less about saving enough for when they’re older (63% planners vs. 73% non-planners), and spending too much now in case they run out of money in future (63% planners vs. 69% non-planners).

They’re also more comfortable with the amount of savings they have (35% planners vs. 17% non-planners) and happier to take more risks with their money for the chance of higher returns (31% planners vs. 20% non-planners).

It’s clear that planning both elevates women’s financial positivity levels and softens the blow of present and future money worries.

Making it easier for your clients’ female employees to get a holistic view of their finances could be a good way to encourage them to plan for today, and for their retirement.

For instance, Standard Life’s Money Mindset tool, created in partnership with Moneyhub, uses open finance technology to allow users to connect bank accounts, mortgages, savings, and pension plans into one central place. Seeing a snapshot of their overall finances could make it easier for them to see what savings they have now, and what income they could get in retirement.

Not only that, users can get personalised tips to help them make small changes to their spending and saving, which could help improve their financial wellbeing in the long term.

Planning can help boost women’s financial confidence and knowledge

A drop in financial confidence and knowledge is another casualty of the economic crisis. Just 43% of women say they feel comfortable understanding financial products, down from 50% in 2021. And only 52% say they feel confident making financial decisions, down from 57%.

Yet again, planning offers some respite, with financial product knowledge and financial confidence rising to 52% and 58% respectively for female planners.

Again, your clients can help support women in their pension planning through tailored and targeted content that’s engaging and easy to digest. In addition, they can help break down barriers to financial understanding and confidence by encouraging open conversations with their female employees. At Standard Life, we’ve been talking to women in the workplace about what financial advice they would give their younger selves, to promote an open dialogue between women of all ages, backgrounds, and at different stages of their career.

Of course, much more needs to be done to help improve women’s retirement incomes. Phoenix Insights’ Caught in a Gap report (2022), produced in partnership with the Institute of Employment Studies (IES), outlines the barriers that women face as a result of the gender pension gap and how employers can help close it. Supporting women in their pension planning journey is just one of many ways that your clients can make a big difference to their financial future.

For more insights and tools, visit our Financial Wellbeing hub and read our articles.