Rita Butler-Jones : Why safeguarding nature helps safeguard pensions

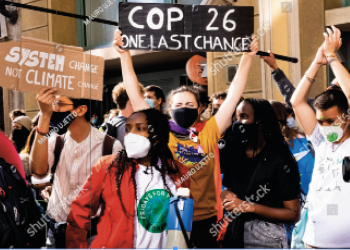

According to the Intergovernmental Panel on Climate Change, if we heat our planet by 1.5°C, we will lose 70% of the world’s coral reefs. At 2°C or more, the pathway many scientists...