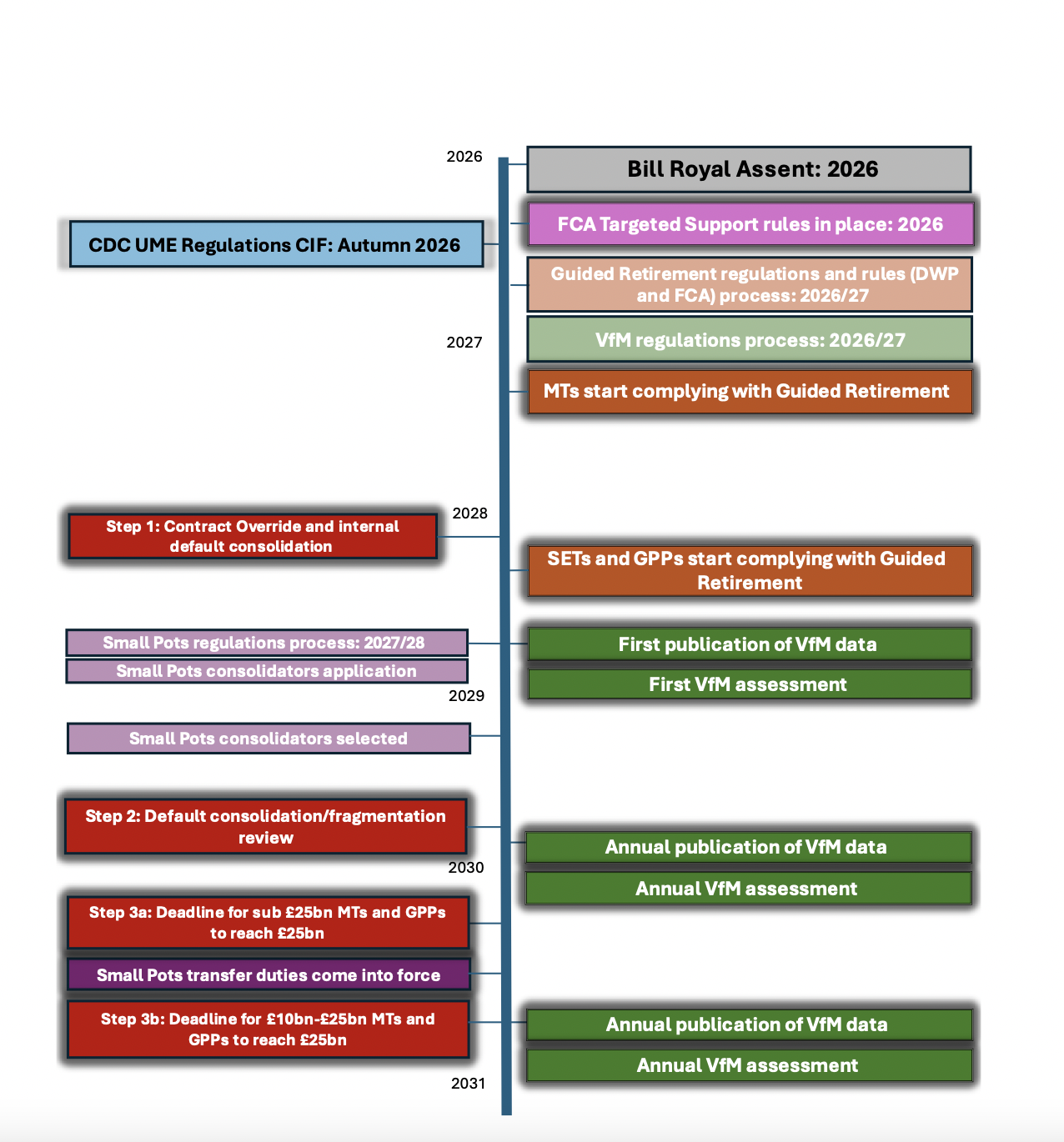

The Government has set out a proposed timetable for the raft of regulation included in today’s “game-changing” Pension Schemes Bill.

This roadmap, which has been broadly welcomed by the industry, sets out the order in which the various pension reforms will take place between now and 2030. Many of these will have a significant impact on the wider DC workplace pensions market.

As the road map makes clear this Bill is expected to get Royal Assent in next year, in 2026, with the FCA rules for targeted support expected shortly afterwards.

This will be followed by the process for setting out guided retirement regulations, to be led by both the DWP and FCA, and the start of the process to set out the Value for Money regulations — with a view to the first VFM data being published in 2028.

When it comes to complying with the new regime around default retirement solutions, master trusts will need to start offering options in 2027, with GPPs following suit in 2028.

The small pot consolidation process will not start until after the large scheme consolidation, driven by the Pension Investment Review.

The roadmap also indicates that the second phase of the pensions review, looking at adequacy, will take a wide-lens approach and look at the state pension, workplace pensions and wider wealth and savings.

The government has said that these are ‘indicative dates’ but hopes these major reforms will all be implemented by 2030. While the industry welcomed the roadmap, many said it remains a challenging timetable.

In the accompanying document, setting out the rationale for the measures contained in this Pension Schemes Bill, the Government cites the CAPAdata published by Corporate Adviser, which shows the disparity in returns between leading default funds. The Government says this timetable of reforms is necessary to address this issue and help drive up returns for all savers.

Aegon pensions director Steven Cameron says: “With an unprecedented volume of major Government-led change ahead for workplace pensions, it’s extremely important to understand how the various initiatives fit together.

“We’ve been calling for the Government to publish a roadmap and welcome today’s document. This shows beyond doubt just how challenging it will be to get the implementation right. We’re pleased to see the dates are indicative and not set in stone, particularly when much of the detail remains unknown.

“We’re pleased to have confirmation that small pot consolidation won’t start until after the scheme consolidation driven by the Pensions Investment Review has largely concluded. Attempting scheme and small pot consolidation concurrently would have been a recipe for disaster.”

Cameron adds: “Perhaps the most surprising date on the timetable is that master trusts will have to start complying with Guided Retirement solutions in 2027, with GPPs a year later. Designing and implementing appropriate default retirement solutions for non-engaged workplace members will be hugely challenging. The ‘right’ retirement solution is highly personalised and different solutions will be needed for different groups depending on their need for security, attitude to risk, their health, any dependants and what other pensions they have.

“We do hope the Government keeps an open mind on the roadmap dates, and continues to monitor progression – while we understand the Government’s desire for speed, it’s far more important to the millions of pension savers that the changes are ‘done right’.”

Hymans Robertson head of DC consulting Kathryn Fleming adds: “The aim for this Pension Schemes Bill is to reshape the market and the roadmap makes sense at a high level, helping providers to make key strategic decisions to invest or consolidate with the backstop of 2030.

“It’s positive to have yet another opportunity for the FCA and TPR to work together to get greater alignment in the retirement experience for future savers. In this example, by having a Guided Retirement product that applies to both trusts and group personal pension plans. We have to be conscious of the fact that the wants and needs of members in decumulation are vastly different, so there will always be members that a default decumulation solution won’t be right for.”

Flemng adds she was pleased to see that the government was taking a more holistic approach with the second phase of its pension review on savings adequacy.

“This will take effort from the industry. It’s imperative that when we consider adequacy, we work together collectively to define it for the good of the industry and our members. Not only will we have to look at the affordability of pension contributions but also whether we need to address the accessibility of members’ savings that have been set aside for the longer term. The degree to which we can personalise the savings experience to each individual to meet their individual needs is another vital factor.

“In the review it would be good to see more fluidity between short and long-term savings. As outlined in our paper, The Untapped Potential of Pensions, we believe that considering the role that pensions can play to help people access the housing ladder is a vital element of this innovation.

“Building on the success of defaults, we are excited to explore the role that default safety net solutions, like sidecar as trialled by Nest Insight, will play in helping to achieve adequacy.

“With a common and unified, definition of adequacy, we can build a roadmap similar to the one that we have seen today for building out scale and value. It is clear that this government is addressing pensions and bringing change in a way not experienced for decades. Employers and trustees should be delving into the realities of today’s change and thinking about how they can form a practical, well-communicated and beneficial member experience.”