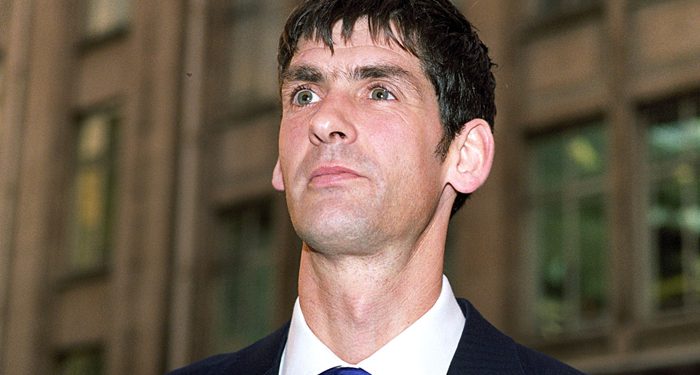

Hargreaves Lansdown head of pensions research Tom McPhail, who is a frequent contributor to Treasury pension legislation consultation, says a move away from the current system of tax relief at the individual’s marginal rate is increasingly unlikely.

The firm says amongst its clients, contributions from higher and top-rate taxpayers are up 61 per cent since the Summer Budget on 8 July 2015, compared to the same period last year, and up 120 per cent so far far this tax year compared to last tax year.

McPhail argues that the pension Isa move from taxing withdrawals to taxing contributions is unlikely to be favoured. McPhails says the proposal lacks a visible incentive to get savers to contribute, would lead to accelerated withdrawals as there would be no tax break on taking money out and would be complex to implement leading to a two-tier withdrawal taxation system for decades.

But CPS fellow Michael Johnson says his pension Isa proposal has always included a proposal for a matched contribution from the government to encourage savers to tie their money up until retirement.

A recent paper from Morgan Stanley argues the pension Isa is the frontrunner scenario, saving the Treasury between £12bn and £19bn a year.

McPhail says: “The game is up for higher rate tax relief; higher earners may feel that’s unfair but the Chancellor needs to balance the books and where else is he going to go but to the people who have the most money. Savvy investors are making the most of these earnings related top-ups while they still can.

“Any move to scrap the up-front incentive altogether could have disastrous consequences; investors were very clear that they prefer the ‘bird in the hand’; not surprisingly, they don’t trust future governments to honour promises made today. The idea of a ‘pension ISA’ is a non-starter.”

“There is also an interesting challenge to the government in building a consensus for any reforms. Investors are very clear that they want a stable a long-lasting pension system. Given the upheavals in the Houses of Parliament in the past 6 months, this may not come easily.”

Johnson says: “We have a very jittery industry at the moment because people are expecting change of some sort. Clearly no-one is expecting the status quo to remain. I have always said if you go to Taxed, Exempt, Exempt, you also include an employer top-up.”